Nigel Pritchard of Barnsley-based container manufacturer Rexam Glass has also called on local authorities, WRAP, packaging waste compliance schemes and the rest of the glass sector to work together to create a stable economic platform for glass recycling.

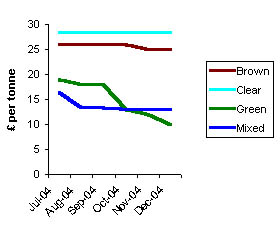

Mr Pritchard was responding to the latest drop in the price that local authorities are paid for green and mixed glass. Prices offered to councils for a tonne of green glass have dropped from between 16 and 22 in July 2004 to about 8 to 12 a tonne this month.

Recycled glass prices, July to December 2004, from the letsrecycle.com price archive |

The price of mixed glass has dropped from 15 to 18 a tonne in July to 11 to 15 a tonne this month – and collectors have told letsrecycle.com they will offer even less if the mixed glass contains only green and amber glass.

The drop in price has come partly because of the recent slump in glass packaging waste recovery notes (PRNs), which have dropped from over 20 a tonne in July 2004 ago to just under 10 a tonne in December 2004.

Mixed

Defra funding and weight-based local authority recycling targets has led to a jump in the amount of glass collected through new kerbside services, but Mr Pritchard warned this has brought about a “huge swing towards mixed colour glass collection”.

The additional mixed glass collections require new investment in sorting technology, but the biggest headache for reprocessors is what to do with all the green glass once the mixed glass has been separated. Mr Pritchard explained: “Mixed glass contains on average 50% green glass, while UK food and drink manufacturers use predominantly clear and amber glass.”

He added: “Long-established bring systems, which provide colour-separated glass are also affected and are now in decline.”

Danger

The surplus green glass has traditionally been sent by the glass container industry for use in aggregates. But with aggregates firms paying only a few pounds per tonne, the arrangement has had to be subsidised by the revenue from packaging waste recovery notes (PRNs), but this revenue has dropped with the recent 40% drop in PRN prices.

Mr Pritchard said: “With the economics of surplus green glass already heavily dependant on volatile PRNs there is the danger that growth and investment in glass treatment capability will be reduced severely.”

”There is the danger that growth and investment in glass treatment capability will be reduced severely.“

– Nigel Pritchard, Rexam Glass

The Rexam Glass director said the glass industry now has to “face up to a low PRN economy” and not rely on PRN revenue to create growth in recycling. He said alternate markets were now key to future growth, and that prices for collected glass “could fall dramatically if we are to succeed in our recycling targets as a nation”.

WRAP

Mr Pritchard stressed that councils would still save on landfill fees by collecting glass for recycling. But he said research by WRAP – the Waste and Resources Action Programme – had not been enough to bring about commercial viability of new alternate markets.

He said: “WRAP has the role of researching and identifying new markets for green glass and has carried out studies into its use in bricks, water filtration and even bunker sand on golf courses. Whilst its research has found many of these to be technically possible, they have not been commercially viable for glass reprocessors.”

Food and drinks manufacturers also had a role to play in looking at the balance of how much of each colour is consumed and produced in the UK, Mr Pritchard said.

Subscribe for free