PRN income is designed to provide “top up” funding to make the process of collecting and recycling both existing, and increased tonnages, of packaging waste viable. It is not intended to cover all the costs involved or to be sufficient to completely fund new systems or capacity.

The immediate beneficiaries of PRN funds are the accredited reprocessors and exporters that receive the packaging waste for recycling or recovery. Approximately 63% of funds in 2018 was used to support the collection and processing of recyclables.

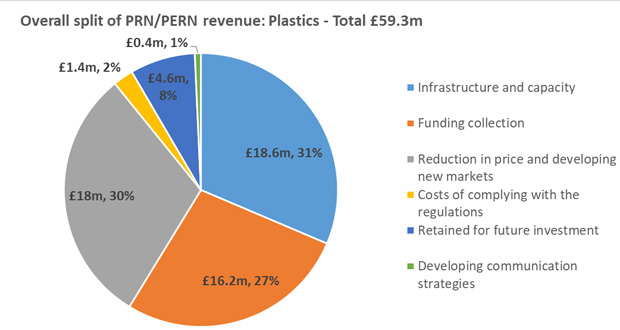

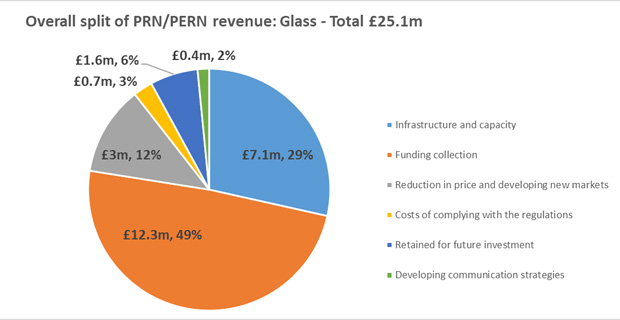

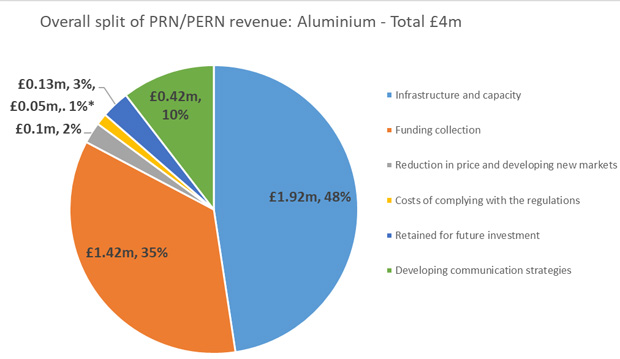

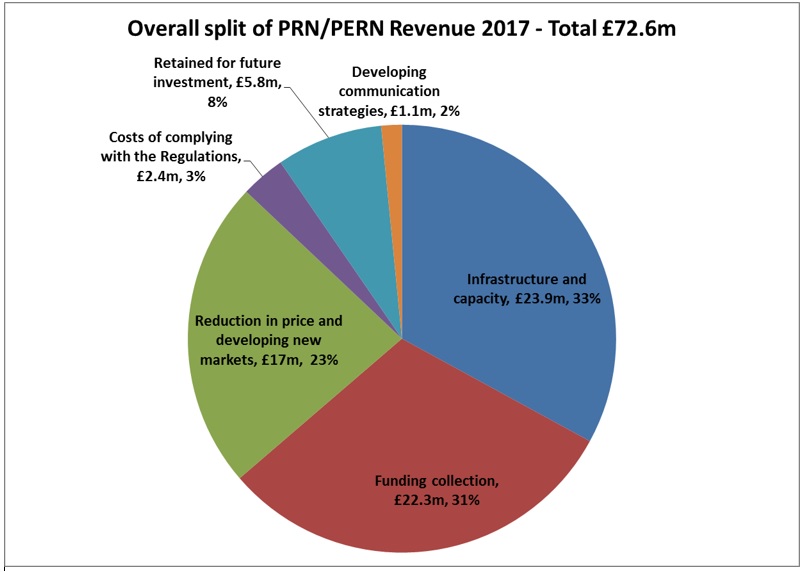

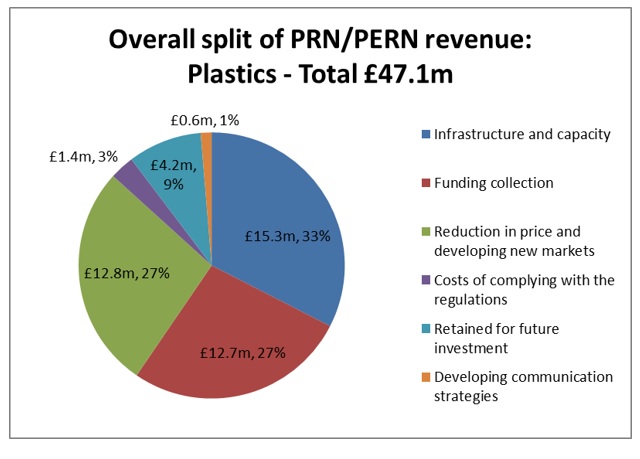

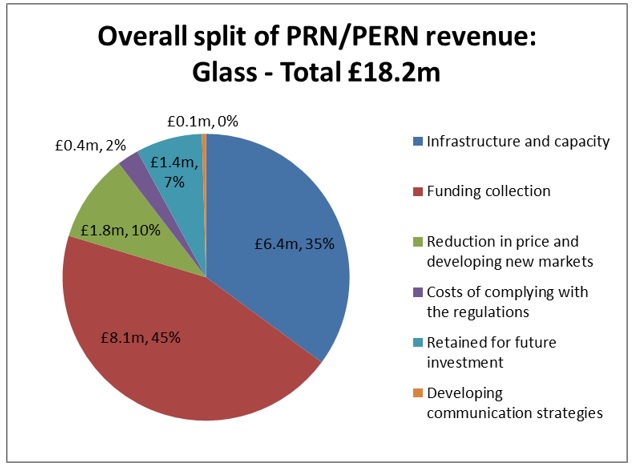

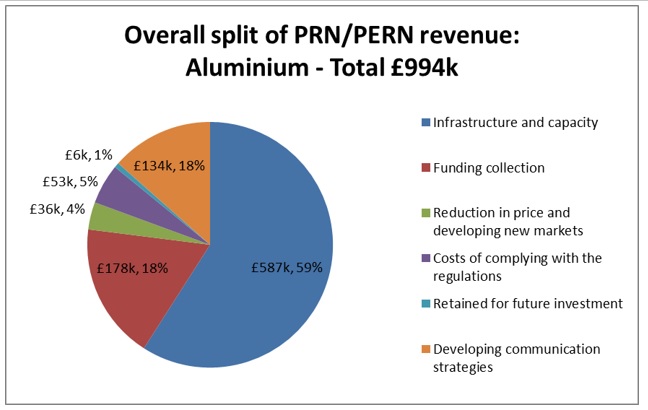

[Below you will find charts of funding allocations for 2017 and 2018 and examples of PRN spending]

PRN usage/revenue categories

Infrastructure and capacity: Investment in infrastructure and the development of capacity for the collection, sorting, treatment and reprocessing of packaging waste. This includes investment to equipment used for processing material, for example glass sorting plants that colour sort mixed glass and remove contaminants to allow use for remelt and higher grade applications.

Funding collection: Funding provided to other persons involved in the collection of packaging waste. For example enabling collectors to extend collection range or collect amounts which would otherwise not be economically viable to collect.

Reduction in price and developing new markets: Reductions in the prices of, and the development of new markets for, materials or good made from recycled packaging waste. This could for example include subsidising a product containing recycled material to allow the product to compete within the market.

Costs of complying with the regulations: Reprocessors are required to be pay fees to the enforcement authority each year for accreditation and will also have costs to maintain accurate records and generation of PRNs. (This does not include producer registration fees).

Retained for future investment: Funds retained for future investment. PRNs are generated throughout the year however sales do not complete until the following January, therefore reprocessors need to carry forward funds into the next year as they have not received them in the current year.

Developing communication strategies: The development of a communications strategy for consumers of packaging made from recyclable materials. For example, promotional leaflets to encourage recycling and supporting local authorities in specific recycling campaigns

Revenue expenditure charts

The pie charts below show how PRN/PERN revenue was spent by accredited reprocessors and exporters in 2017 and 2018, based on data published by the Environment Agency. The full Environment Agency data set, which is available on the National Packaging Waste Database, can be found here.

As a supply and demand system, PRN prices, and therefore PRN revenue, can fluctuate each year according to the market conditions. There can also be substantial differences in funds depending on the material, as shown in the material specific charts below.

2018

(Charts courtesy of Valpak; figures rounded to nearest £100,000)

2017

PRN Investment case studies and reports

Some examples of recent PRN investment by reprocessors as well as investment in recycling by packaging producers, compliance schemes and waste management companies can be found below:

PRN Revenue tops £130m in 2018 (May 2019)

https://www.letsrecycle.com/news/latest-news/working-in-partnership-for-paper-quality/ (May 2019)

Encirc opens £40million Cheshire glass furnace (June 2018)

Veolia opens St Helens glass recycling facility (March 2018)

Vanden expands Cambridgeshire plastics facility (July 2017)

Biffa Polymers open new recycling line following £7 million investment (May 2017)

Ward Recycling in glass cleaning and MRF investment (May 2016)

Plasgran boosts compounding capacity with Erema investment (May 2016)

Viridor invests £2 million in Sheffield glass sorting line (April 2016)

Biffa to double HDPE milk bottle recycling capacity (April 2016)

ACP chair: Councils are seeing PRN money (October 2015)

Viridor opens £25m glass recycling facility (September 2015)

Biffa invests £3.1m in glass cleaning (June 2015)

Packaging committee considers PRN transparency (May 2015)

Aluminium and recovery hit hard in Q1 packaging data (April 2015)

Q4 2014 packaging data indicates strong year for glass (March 2015)

Ella’s Kitchen launches recycling initiative (March 2015)

PRNs ‘could drive up’ R1 registration (January 2015)

Plastics recycling trial targets trigger tops (December 2014)

Beatson Clark increases capacity with amber glass furnace (December 2014)

Packaging prowess (December 2014)

Pledge 4 Plastics recycling campaign launched (September 2014)

Councils may get more support for remelt glass (May 2013)

Recresco glass recycling plant set for Kent (April 2013)

Higher PRN prices boost glass recycling levels (January 2013)