Consequently, the value of glass remelt PRNs has exceeded £60 in recent weeks, as “nervousness” grows in the market.

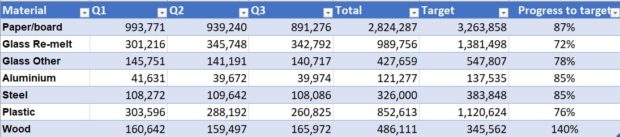

As outlined below, most materials appear to be comfortably reaching their likely totals for the third quarter of 2021.

Concern

The prices for glass remelt PRNs have crept up in recent months – glass remelt PRNs are issued for glass melted to make new glass rather than for glass used in outlets such as aggregates, which is ‘glass other’. The rise in price is mainly due to concerns that there could be a shortfall partly because the hospitality sector was closed throughout the lockdown at the start of the year, meaning tonnages were down.

Other factors as to whey there is an apparent shortfall in glass remelt PRNs so far, include that there have been delays in some exports. And, one glass recycling expert told letsrecycle.com that he thought some businesses were “sitting on evidence”, which is also contributing to the data being slightly off-target.

Concern

Martin Trigg-Knight, head of packaging at the compliance scheme Clarity Environmental, told letsrecycle.com: “The Q3 figures, along with the confirmed recycling targets for this year, provide a mixed view across materials.

“Glass remelt production will be a key concern for the sector, with the current figures suggesting that achieving 2021 target could be close and with very little carryover. The overall picture for other grades looks positive despite the uncertainty at the beginning of the year. The next few months will be crucial for glass, with flexible end market support from PRNs rising to facilitate increased recycling.”

Hospitality

Jon Redmayne, managing director of the European Recycling Platform compliance scheme, said that with carry-over tonnage from 2020 and the hospitality sector now fully open, he was confident the target would be met and there would not be a shortage of material.

He told letsrecycle.com: “Overall the Q3 packaging data looks encouraging in terms of PRNs relative to volumes required.

“There has been some discussion about glass remelt where the data shows 72% of the estimated material obligation covered by material accepted – slightly below the 75% we would hope to see at this point.

“However, with nearly 81,000 tonnes carried in from 2020 and the hospitality sector having fully reopened over the summer we consider that there is unlikely to be a shortage of material in this class.”

PRN

Echoing this was Paul Van Danzig, policy director at Wastepack, who said the high prices of the glass PRN would encourage greater recycling in the fourth quarter.

He told letsrecycle.com: “There is a high degree of nervousness in the markets around glass remelt, which is having a knock on effect on the industry. I think it’s unlikely the target will be missed however. The high prices we’re seeing at the moment will encourage greater recycling, which is exactly the point in the system.”

‘Volatile market’

Clement Gaubert, head of operations at compliance scheme Ecosurety, observed that carry-over of PRNs from last year would be needed to meet this year’s glass recycling obligation.

“Glass remelt is showing the worst progress against the annual target across all materials. Carry-over volume will be required to meet the target this year, which will already put pressure on achieving compliance for 2022,” he said. “We can expect an extremely volatile market for glass remelt PRNs in the coming days and weeks.”

Subscribe for free