The results referenced Renewi’s integration last year of Brosen the owner of The Furniture Recycling Group in the UK which adds to its Dutch mattress and furniture recycling business RetourMatras. Renewi remarked on this as its “first international expansion completed with the integration of TFR Group in the UK”.

The results document is also peppered with references to the UK, notably around its loss-making contract with the East London Waste Authority.

‘Great efforts’

Commenting on the results, Otto de Bont, chief executive officer, said: “Renewi has had another successful year. Thanks to the great efforts of our employees and the loyalty of our customers we have been able to cope with some extraordinary circumstances, including high inflation. We have also achieved significant progress with the execution of our strategy: increasing our recycling rate, our investments in advanced sorting in Belgium, producing secondary materials to the highest standards for children’s toy production and extending our leading position in the Netherlands by a key acquisition in the construction and demolition market in Amsterdam.”

Mr de Bont added: “Our purpose has always been to give new life to used materials, and our vision is to be the leading waste-to-product company in Europe’s most advanced circular economies. We are proud to be the leading operator in the Netherlands and Belgium, where the adoption of the circular economy is one of the highest within the European Union. We have made significant progress during the year to build on our position as a leader in the circular economies in which we operate.”

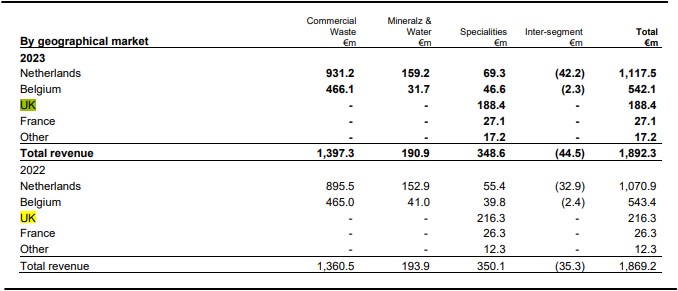

The results show a revenue for the financial year to 31 March 2023 (in unaudited accounts) of €1,892m and underlying earnings before tax of €132.9m which were similar to the prior year (FY22: €1,869m and €133.6m respectively). Renewi said that during the year it had effectively mitigated lower recyclate prices, lower volumes and high inflation through ongoing cost control and customer price increases.

Prudent

In the UK, which contributed £188 million in revenues during the financial year, Renewi said that its municipal performance “was stable as we continue to manage contract costs closely and have a team who are focused on using innovation and prudent cost management to ensure that the risks are managed carefully”.

We continue to manage contract costs closely

Nevertheless, based on what it says is the inflationary outlook in the UK, assumptions on both lifecycle spend and cost inflation, combined with lower volumes at its loss-making East London Waste Authority contract, have necessitated a €27.1m increase to the associated onerous contract provisions. “In addition, an amendment to an accounting standard resulted in an increase of €52m to the opening onerous contract provisions which has no impact on cash and no change in the underlying performance of the contracts”.

During the year, Renewi undertook an in depth analysis of its municipal contract with East London Waste Authority which is due to expire in December 2027. Complexities around leasing arrangements under the contract are reported on in the annual results.

Shanks pension fund

Renewi took on the East London contract when it acquired Shanks in the UK. Reference is made to Shanks in the funding report for the year in terms of the Shanks pension fund. The document notes that: “The legacy Shanks UK defined benefit scheme moved by €12.9m from an asset of €8.6m at 31 March 2022 to a deficit of €4.3m at 31 March 2023. This was due to lower returns on pension scheme assets which were only partly offset by an increase in the discount rate assumption on scheme liabilities.”

Subscribe for free