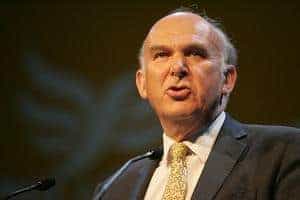

In a written ministerial statement setting out his plans for the bank which was published today (December 12), Mr Cable listed them among just five sectors which would receive up to 80% of the funds over the Spending Review period to 2015/16.

Mr Cable also announced the creation of a new team within his department, known as UK Green Investments (UKGI), to help accelerate the development of low carbon projects while the Bank is set up in accordance with State Aid Rules. He said this wouldinvest 100 million in waste projects from April 2012.

This is likely to be welcomed by many in the waste sector, who have been critical about the length of time it is taking to set up the Bank and for it to distribute funding.

Bank

The Green Investment Bank is being set up to help leverage private investment in environmental projects. Chancellor George Osborne first confirmed plans to set up a Green Investment Bank in his Budget speech in June 2010 (see letsrecycle.com story).

In May 2011, Deputy Prime Minister Nick Clegg said that the Green Investment Bank would begin operating in April 2012 and indicated that the bank’s early targets would be “offshore wind, waste and non-domestic energy efficiency” (see letsrecycle.com story).

In todays statement, Mr Cable explained that he was in a position to formally announce the proposals for the Green Invesment Bank. He explained that the bank would operate independently from the government but would agree its strategic priorities for each Spending Review period. And, for the Spending Review period to 2015/16 he said the following priority sectors had been identified:

- Offshore wind power generation;

- Commercial and industrial waste processing and recycling (thisemerged late lastmonth inChancellor George Osborne’sAutumn Statement);

- Energy from waste generation, including gasification, pyrolysis and anaerobic digestion for the production of heat and/ or power;

- Non-domestic energy efficiency, including onsite renewable energy generation and heat; and

- Support for the Green Deal (scheme to support energy efficiency measures in households).

Mr Cable added: At least 80% of the funds committed by the Bank over the Spending Review period will be invested in these priority sectors.

UKGI

On the subject of the UK Green Investments team, Mr Cable said that it was clear, in advance of State Aid Approval for the Green Investment Bank, that the government needed to take immediate action to accelerate private investment in the UKs transition to a low carbon economy.

I have therefore set up a new team within my department to drive investment in the UKs green infrastructure from April 2012, he said.

The team, which will be called UK Green Investments, will be staffed by finance professionals, whose track records are widely known and respected in the City UKGI is also seeking managers for up to 100 million to invest in waste projects and is now calling for expressions of interest from experienced fund managers in the waste infrastructure sector.

Objectives

In his statement, Mr Cable explained that bids for funding from the Bank will be assessed according to three objectives which are:

- Green Impact: accelerating investment to advance the UKs transition towards a Green economy, including reducing greenhouse gas emissions; improving resource efficiency; and protecting and enhancing the natural environment and biodiversity, which includes improving water and air quality, reducing noise pollution and improving land use amenity;

- Sound Finances: deploying capital and expertise as a responsible investor and managing risks to achieve positive portfolio returns and, in so doing, preserving and building its capital base as an institution with enduring Green Impact; and

- Additionality: operating alongside other market participants in response to market failures, leveraging their capabilities where appropriate, to introduce and mobilise additional investment and achieve Green Impact

Related Links

Mr Cable said that around 20 locations had expressed an interest in hosting the bank and that a decision on this would be made in February 2012. But, he explained that it was likely to have between 50 and 70 staff in the period to 2015. A company is due to be formed shortly and Mr Cable said that the formal recruitment process for the board and senior management team would begin next month, with a view to appointing a chair in Spring 2012.

Subscribe for free