German investment firm Aurelius bought the assets and business of ECO Plastics, based at the Hemswell industrial estate in Lincolnshire in December, after the firm was placed into pre-pack administration. ECO Plastics had made a loss of £12.5 million in the two years leading up to the sale.

A new separate company trading as Plastics ECO Ltd, and now renamed ECOPlastics Recycling Ltd, was set up by Aurelius and took over the operations of the Hemswell site.

All of the original ECO Plastics staff were transferred over to the new entity as part of the deal, with the debt amassed by ECO Plastics – totalling more than £14 million – being kept by the old company ECO Plastics Ltd, which remains in administration and could be wound up.

letsrecycle.com has learned that the new ECOPlastics Recycling Ltd is undergoing a month long consultation to assess the future of the business, with the position of more than 40 staff from across its operations under review.

Already two senior figures within the company have departed – commercial director Duncan Oakes, who had spent more than ten years at ECO Plastics, and the firm’s technical director Simon Faulkner, who departed in January.

Strategy

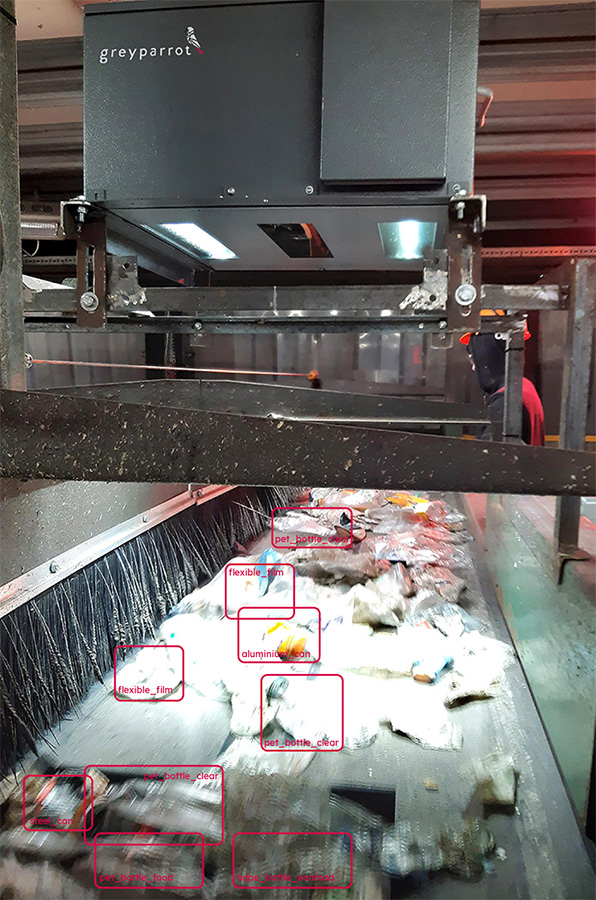

Sources within the plastics scrap sector also report that ECOPlastics is realigning its buying strategy, purchasing fewer mixed bottles and instead focusing on bringing a greater tonnage of clear PET bottles into its 150,000 tonnes per year capacity recycling plant.

The news of restructuring at the Lincolnshire site come days after the release of financial documents from ECO Plastics Ltd’s administrators Grant Thornton revealing that the overall debt amassed by the time the company was plunged into administration in December stood at £14.3 million.

However, the letter states that based on the directors’ asset realisation and liability estimates creditors are expected to recoup around £0.5 million of that owed, a return of around 3p/£.

Creditors

Among those counting the cost of ECO Plastics’ collapse are waste management companies, some of whom are owed close to £1 million, as well as local authorities – with around £167,000 owed to seven councils. Other creditors include equipment suppliers and the Environment Agency.

The letter also reveals that Close Leasing Ltd, which provided plant machinery to ECO Plastics under a hire purchase arrangement, terminated its arrangement with ECO, and the assets were purchased by the new company for close to £7.9 million.

Other investors in the £15 million Hemswell plant, which opened in 2010, included the Waste & Resources Action Programme (WRAP), which provided a £1.65 million loan, and Coca Cola Enterprises (CCE).

WRAP has since written off its £1.65 million loan to ECO Plastics, after concluding an ‘equity arrangement’ with the new investors, while Coca Cola Enterprises (CCE) has terminated its joint venture with ECO – Continuum Recycling, instead entering into a “long term agreement” to source rPET from the company.

ECO Plastics had been seeking a buyer after being affected by a downturn in the PET market, and filed a notice of intention to appoint joint administrators David Michael Riley and Joseph Peter Francis McLean of Grant Thornton LLP on November 28 2014 – two weeks prior to the Aurelius deal.

Subscribe for free