The Board – which provides a strategic steer over waste in the capital and distributes funds – has agreed a new investment framework for investing £20 million over the next five years.

In the past, LWARB has only invested in infrastructure projects, with recipients including TEG and PlasRecycle (see letsrecycle.com story). However, following discussion with industry and the Greater London Authority, it will now provide support to new and existing businesses via corporate loans and venture capital.

A report discussed at a meeting of the board last Friday (November 7) explained: “This Investment Framework will allow LWARB to continue to deliver new infrastructure projects, through project finance and a new equity investment vehicle. It will also support existing businesses to expand and improve their operations through corporate investments. New infrastructure developments will also be helped through the offer of secure development loans and, for early stage businesses, LWARB will look to create a venture capital fund with industry partners.”

New area

Discussing the corporate loans in more detail, the report highlights how this is a “new area” for LWARB and that it hopes to make 5-10 investments in this way.

It says: “The kind of businesses looking to expand that cannot attract corporate debt will typically present a higher risk to lenders. LWARB will seek to secure loans against property, or more likely, against purchased equipment. LWARB will also consider providing debt to collection business seeking to expand on the back of good operational history.”

But, the report stresses that due to its limited budget, LWARB can only help to deliver a small number of projects. Therefore, it says that its focus is on “optimising leverage of funds and delivery by helping to de-risk those projects that are on the margins of private sector delivery.”

Separate collections

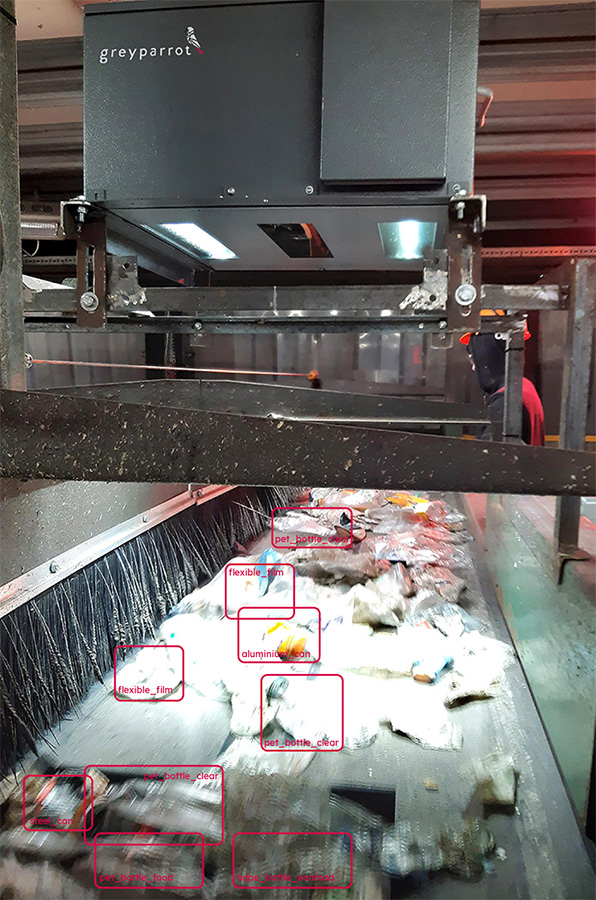

LWARB envisages that investments may be required by MRF operators needing to upgrade equipment to enhance sorting quality in light of the requirement for separate collections and and MRF Regulations, as well as the Chinese ‘Green Fence’ initiative. Funding may also be allocated for reuse and remanufacturing activities.

A call for expressions of interest is due to be published following tomorrow’s announcement.

Earlier this week, LWARB announced plans to form a new partnership with WRAP to help boost recycling rates in the capital (see letrecycle.com story).

Subscribe for free