The notice was published yesterday afternoon (31 July), three days after it was revealed that the company, which was “industry led and funded”, owed £86 million (see letsrecycle.com story).

Biffa Waste Services, which is owed £65 million, was listed as an unsecured creditor.

The notice of proposals says: “Based on the current estimates, we anticipate that unsecured creditors may receive a nominal dividend, the quantum and timing of which is unknown.

“We have yet to determine the amount of this, but we will do so when we have completed the realisation of assets and the payment of associated costs. We estimate that unsecured claims against the company amount to C.£80 million, based on the information currently available.”

Employees, who are owed £80,000, are expected to receive payment in full. HMRC is also expected to receive the £110,000 it is owed.

The administrator, Interpath Advisory, explained that it anticipates “the administration process will end via dissolution”.

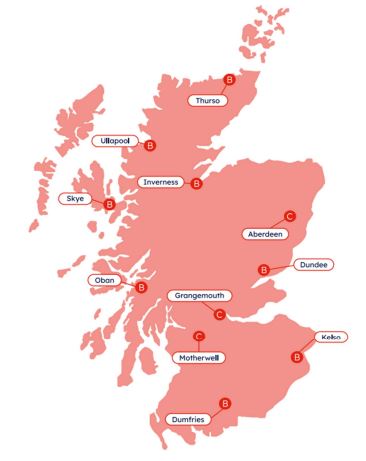

Biffa signed a 10 year deal to be the logistics partner for the Scottish DRS in June 2022 (see letsrecycle.com story). Biffa said around £80 million would be “deployed by August 2023”. The waste management company unveiled multi-million pound plans for counting and baling plants in Aberdeen, Kelso and Motherwell.

Assets

The notice explains the Circularity Scotland had £1.8 million in the bank. It was also due a VAT refund of £400,000. Physical assets in the office were also sold to the landlord for £28,500.

The administrators are also “reviewing affairs” of the company to find out if there any “actions which can be taken against third parties to increase recoveries for creditors”.

In terms of costs, since being appointed in June the administrators have incurred costs of £150,000. £11,000 was paid to the four remaining employees, as well as £5,718 in pension contributions.

Therefore, due to the scale of the debt owed to creditors, Interpath say dissolution is the likely option.

Circularity Scotland

The company was incorporated in November 2020 to administrator the DRS, but following the announcement in April that the scheme has been delayed from March 2024 to October 2025, “it was clear that the business could not continue to operate without further funding”.

However, it was not possible to secure this as producer groups who were funding the scheme pulled out. This meant that 34 of the 38 employees were made redundant upon appointment.

The Scottish government blamed the UK government for not allowing the scheme to progress with glass included, while the former chief executive of Circularity Scotland, has blamed the Scottish Government, saying the scheme could have progressed with glass.

The administrators were formally called in on 20 June (see letsrecycle.com story).

The Scottish government blamed the UK government for not allowing the scheme to progress with glass included, while the former chief executive of Circularity Scotland, has blamed the Scottish Government, saying the scheme could have progressed with glass.

WITHOUT GLASS HE SAID