In its half year results for the first six months of the financial year (April-October), published today (5 November), the company posted an underlying profit before tax of £1.2 million, down from £29.7 million last year.

However, Biffa says the results show the company is “emerging strongly” from the pandemic, pointing to the fact its net revenues grew from £202.5m in the first quarter of the 2020/21 financial year to £256.3m in the second quarter.

Its earnings before interest, taxes, depreciation, and amortisation also recovered from £19.3m to £39.0m.

Michael Topham, chief executive of Biffa, said: “I am very pleased with the performance of the business and the progress we have made in delivering our strategic objectives in the first half of the year, in extremely challenging circumstances.

“We responded swiftly to the first wave of the pandemic and have emerged strongly in recent months, with group net revenue in September recovering to 93% of prior year levels.

“This is ahead of our base case expectations and demonstrates the resilience of our model.”

Results

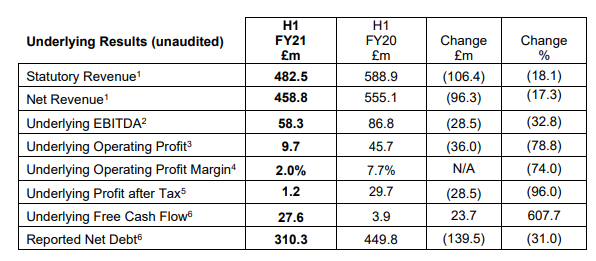

As outlined in the table below, Biffa’s net revenue fell by 17.3% to £459 million when compared with the same period last year, which comes after a 27% reduction in revenues from its industrial and commercial (I&C) division.

Biffa’s I&C division’s revenue fell from £307.6 million in the first half of 2019/20 to £222.5 in the first half of 2020/21. The company’s specialist services division also recorded a drop, of 6.7%. The company’s municipal division actually increased its revenue by 5.5%.

The company recorded an overall statutory loss of £43.2m after tax, the results show.

Recovery

The half year results were not solely gloomy reading for Biffa. The waste management company says its I&C revenues recovered from the first quarter of the year to 94% of prior year levels in September, while landfill revenues recovered to 86% of prior year levels.

“We responded swiftly to the first wave of the pandemic and have emerged strongly in recent months”

The company says it has recommenced its investment programme. Around £40 million has been committed to acquisitions, the company says. This includes its acquisition of industrial and commercial waste collection business Simply Waste last month (see letsrecycle.com story).

Biffa says it has also committed more than £40 million to the Protos energy from waste (EfW) plant and to developing plastic recycling at its facilities in Washington and Aldridge.

Having raised £97.7 million through a non-pre-emptive placing of new ordinary shares of one penny each in the capital of the company in June (see letsrecycle.com story), Biffa says its reported net debt decreased by 31.0% to £310.3m from £449.8m at the end of the 2019/20 financial year.

Lockdown

Biffa says the UK government’s recent announcement of a new lockdown period for England introduces further uncertainty to its short-term outlook.

However, the company says it has benefitted from “stronger than initially expected trading” since the easing of the restrictions put in place under the first lockdown. It says its board’s expectations for the full year remain unchanged.

Mr Topham added: “Whilst we are pleased with the recent momentum in our trading performance and the progress in delivering our strategic investment programme, we remain cautious in our outlook for the second half of the financial year, particularly in light of the further lockdown measures announced by the UK government for England.

“Nevertheless, having successfully navigated the first lockdown, and due to the underlying strength of the group’s performance over recent months, at this stage, our expectations for the full year remain unchanged.”

Subscribe for free