The rise has been put down to a “slow” first quarter in 2022 coupled with rising targets. Other concerns such as higher energy costs, Environment Agency crackdowns and Chinese lockdowns have also been raised as issues that could disrupt recycling and consequently reduce the availability of PRNs or export PERNs.

However, there are still producers to come online so compliance specialists are hopeful this could calm the market soon.

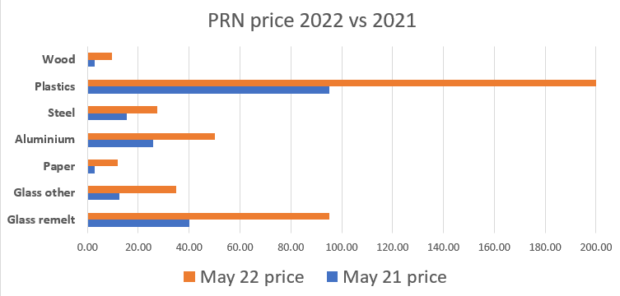

The price of plastic PRNs has risen to as high as £220 in recent weeks, with glass remelt (glass recycled through furnaces into new glass) also as high as £100 and aluminium rising to around £50 while steel PRNs have jumped to around £30.

Even paper, which usually contributes to the ‘general recycling PRN pot’, is now at a near three-year high of £13.

Wood, which is expected to contribute to the general pot this year, is also around the £10 mark for the first time since August 2020 when lockdown hit supplies.

Data

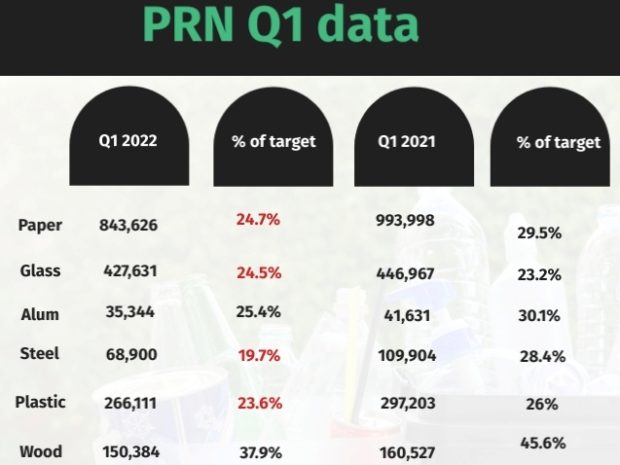

Provisional data published by the Environment Agency in March for the first quarter of 2022 showed that all materials bar glass remelt were behind where they were last year.

This initially led to a hike in prices (see letsrecycle.com story), but many producers had yet to submit data. This also did not include data from Northern Ireland after a miscommunication.

Earlier this month, the Agency published the confirmed monthly data which included more producers, but more are still to come online. This came three days before the producer targets were also published.

As outlined below, this shows that many materials are behind where they need to be proportionately for the 2022 target and on the year so far.

Despite the rises, some compliance specialists have said it is difficult to draw too much from the Q1 numbers, with more reprocessors expected to register.

Others have said the summer months will see more people ‘on the go’, boosting the amount of aluminium and glass in the market. But, the market could also be impacted by a reported shortage of glass bottles and an increase in the cost

Also, in difficult economic times, some companies could go out of business, which could lower the obligation.

Others declaring lower financial results from last year could also fall under the threshold.

It is better that it’s happening now as it helps us spread the cost over the entire year

– Paul van Danzig, policy director, Wastepack

‘Hopeful’

Paul van Danzig, policy director at Wastepack, told letsrecycle.com that the market is “spooked” on the back of the poor Q1 data, and people are concerned that targets will be missed.

“This is leading to people paying higher prices for PRNs, which in essence is what the system is designed to do,” he said.

“It is probably better that it’s happening now as it helps us spread the cost over the entire year. If this happened in Q4, and we were in a position where we couldn’t hit targets, then prices would rise even more.”

Mr Van Danzig added that while the numbers are tight, it is “not the end of the world”, because investment in capacity through the higher PRN prices will help. He added that a few percentage points could easily be made up later in the year.

Prices

As outlined below, the prices being reported at the moment are considerably higher than those from the same time last year. Plastic, steel, paper and glass are among the materials to see their value rise the most highest rises after the release of data from the first quarter.

Targets

After the publication of the Q1 data on 13 May, obligations for 2022 were also published.

This showed that paper’s target rose by around 4% to 3.4 million tonnes, with other materials following a similar pattern. Wood was the only material to see a target reduction. This is due to work taking place to encourage the reuse of pallets.

According to Andrew Letham, operations manager at the PRN trading platform t2e, the combination of target rises and the first quarter data are the reason for the rise. However, he said other factors were at play too.

“Firstly, with the exception of wood, recycling targets have risen across all materials in 2022. Q1 recycling rates were also very poor with most all materials tracking below target in Q1,” Mr Letham said.

“This has seen prices for many PRNs spike from the start of the compliance year with the cheapest PRN – wood/general recycling – currently costing £10 per tonne.”

Mr Letham added: “Paper saw a target increase of 4% this year with supply falling 15.5 % year-on-year in Q1. Sellers have attributed the drop in supply to a lack of available raw material as well as increased volumes of mixed paper moving on a lower PRN protocol.” [This is a reference to more cardboard arising in mixed paper volumes but the protocol only allows for 34.5% of packaging in mixed paper, ie approximately one PRN can be issued per three tonnes of mixed paper.]

Scrutiny

In recent months, the prices of some recyclates have also risen, in particular plastics.

This has led to a 20% year-on-year drop in exports on the Environment Agency’s figures. This has also come at a time when the Agency is upping scrutiny on potential fraud in the industry.

On this, Mr Letham said that while the move to stamp out fraud in what has often been seen as an “unruly market” was welcomed, it “must be tempered with realistic supply expectations”.

He added that the risk to recyclers had increased dramatically and growth may not be the forgone conclusion it has been in previous years.

China

The reason for the poor Q1 data has also been put down to myriad factors.

Sandeep Attwal, group procurement manager at Ecosurety, said exports were impacted by better enforcement of the regulations around PRN issuance by the Environment Agency, and also stricter lockdowns in China affecting demand for reprocessed material. High energy prices have also been hitting global reprocessors.

On a more positive note, she said: “Higher PRN prices are needed to extract extra material from the UK waste stream. If these PRN prices do not achieve an increase the required supply of material, then PRN prices will continue to increase.

“The risks for the rest of the year are centred on recession and energy prices. Whilst the Q1 supply was disappointing, there are still nine months to ensure compliance in 2022.”

Subscribe for free