All agreed that the situation has been compounded by the change in red diesel tax in April, meaning they are being hit with a “double whammy” of extra costs.

With waste operations spanning across collection, processing and transport of materials, the sector is particularly hard hit by the rises.

Simon Ellin, chief executive of the Recycling Association, said costs have “gone through the roof” for his members, both in terms of fuel but also electricity to run machinery.

In his view, this is contributing to the cost-of-living crisis as these additional costs are all factored into the price of the products.

Mr Ellin explained that other issues such as difficulties in the shipping market and the HGV driver shortage also added to the increased costs. “I would estimate that in the 18 months since the beginning of last year, our costs have gone up by a third.”

I would estimate that in the 18 months since the beginning of last year, our costs have gone up by a third.

Simon Ellin

chief executive of The Recycling Association

“We have no choice but to pass the cost on, as we have to keep collecting and processing the material,” he continued. “Around 85% of European cardboard is from recycled sources and that is what all the infrastructure is geared up for.”

Prices

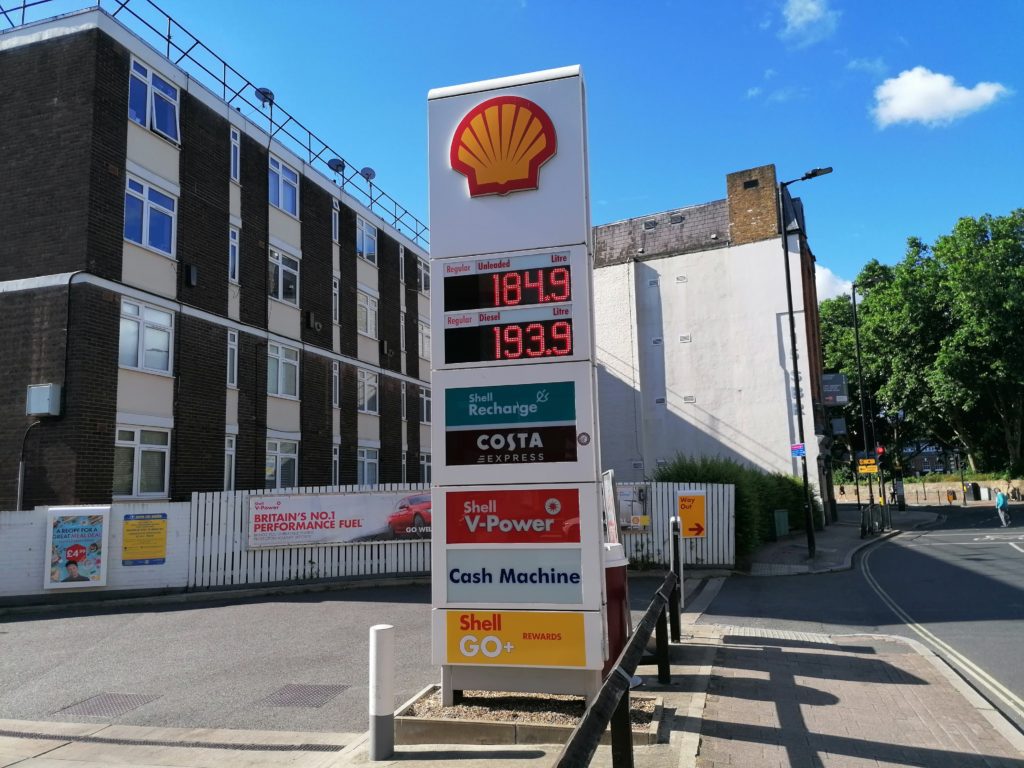

Statistics published by the UK government show that the price of diesel has risen to 186p a litre on average in the UK at the pump.

The insurance group RAC has put the price at around 188.8 p and “likely to rise”. Many places now charge more than 190p a litre for diesel.

This has been put largely down to the war in Ukraine, as well as lockdowns ending in China.

‘Absorbed’

According to Jacob Hayler, executive director of the Environmental Services Association, the rising costs underscore the benefits for local authorities in outsourcing contracts.

He said that the majority of the “significant additional costs” are being absorbed by contractors, particularly on longer-term public sector contracts.

“As a result, local authorities that have outsourced their recycling and waste management services and transferred this risk to the private sector will now be somewhat shielded from these rapid cost increases,” he said.

Mr Hayler added: “The UK recycling and waste sector will likely have to weather this storm, along with the wider economy, while we continue to transition to electric vehicles and other sources of low or zero carbon fuel.”

In-house

Those who have kept their waste services in-house with local authority-owned trading companies could be therefore more at risk.

However, none have said so far that this will lead to any changes in service delivery.

This includes Bristol city council, which owns the Bristol Waste Company, and Liverpool city council with Liverpool Streetscene Services.

A spokesperson for Bristol Waste Company said that despite the soaring costs seen this year, they will be absorbed by the company without a hit to services.

They told letsrecycle.com: “Since February we have seen a significant rise in fuel costs, equating to thousands of pounds a month. We are absorbing costs and have built them in to our business plan. If the costs become unmanageable, we would speak to our owners, Bristol city council, to work out a solution. At no point would this impact the delivery of our services for residents of Bristol.”

Since February we have seen a significant rise in fuel costs, equating to thousands of pounds a month. We are absorbing costs and have built them in to our business plan.

Spokesperson

Bristol city council

Liverpool city council is not anticipating a disruption to its services either. “The costs are being absorbed by our contractor, Liverpool Streetscene Services, who have budgeted for a rise in fuel costs,” a spokesperson for the council explained. “In that regard, there is no impact on public purse.”

Scotland

The picture is similar north of the border in Scotland, with local authorities not suggesting a cut in services yet.

However, Solomon Ede, regional rep for Scotland at the Local Authority Recycling Advisory Committee (LARAC), explained that some councils are advising they "may need to revise service and collection costs to their commercial and industrial customers".

He added: "Some LAs are also reporting that they have not considered any mitigating approach whilst some have advised they are planning a phased replacement of small machinery including vans and forklifts with either electric or hydrogen cell vehicles.

"With regards to bigger vehicles, we are currently assessing the market for vehicles with the range to combat the long distances that these vehicles cover in the course of completing their daily tasks."

‘Consolidation’

Elsewhere, the metals recycling sector uses large amounts of fuel and energy collecting, processing and transporting material across the UK and abroad.

James Kelly, chief executive of British Metal Recycling Association, said that the increase in diesel prices combined with the withdrawal of the entitlement to use tax rebated red diesel could “at least double operational fuel costs”.

“Government’s rationale for the red diesel change was to drive companies towards electrification, which is a laudable aspiration, but not possible at the current time,” he explained. “The move was premature as neither the technology nor the electric grid infrastructure yet existed in sufficient supply.”

The move was premature as neither the technology nor the electric grid infrastructure yet existed in sufficient supply.

James Kelly

chief executive of BMRA

Mr Kelly also agreed that the prices for customers have been pushed up as a result. “Many suppliers will sell to steel mills, which already have high energy costs.”

He added: “Few companies will be able to absorb these excessive rises and most companies will have to pass the cost on or go out of business – we might see some consolidation in the market.”

Subscribe for free