The 47-page document – ‘Reasons for trends in English refuse derived fuel exports since 2010’ – discusses the factors behind the sudden emergence and growth of exports of RDF from England, highlighting the landfill tax as a “key driver” in the market.

As recently as June 2010, the UK was exporting very little RDF, but the market has grown rapidly and in January 2015 215,000 tonnes were shipped out from the UK. The majority of material is sent to energy from waste (EfW) plants in the Netherlands, although Germany and Sweden have also grown as major recipients since mid-to-late 2013.

According to the Agency, there is a “strong correlation” between export levels and landfill tax rates, with continental energy from waste (EfW) facilities initially “setting their gate fees at a level designed to undercut most UK landfill disposal routes”.

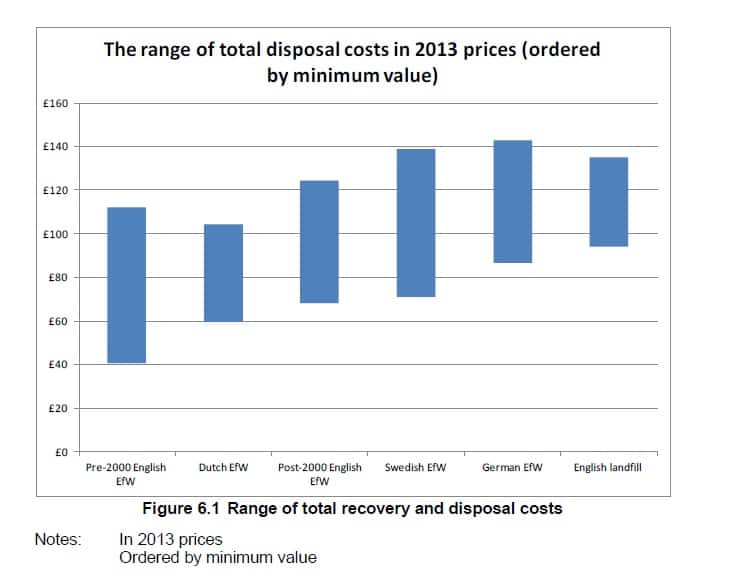

The report found “substantial parts” of the Dutch and Swedish price ranges, and some parts of the German price range, are cost competitive or cheaper than English EfW plants and landfills. English landfill costs, it found, ranged from £94 to £135.

The report states: “The market began in June 2010 after a regulatory decision by the Environment Agency based on the UK Plan for Shipments of Waste, which allowed the export of RDF. The market grew rapidly due to a greater demand for EfW capacity than currently exists in the England.

“This demand was caused by material being shifted from landfill by the landfill tax and landfill diversion targets, and the lower cost of some continental European EfW facilities. It made it economic to produce RDF and export it to continental Europe provided these routes cost less than disposal in English landfills.”

However, the Agency suggests that the export market appears to now be levelling off from its rapid growth since 2010, perhaps because these gate fees abroad are now beginning to reach a similar level to domestic EfW and landfill costs.

Nevertheless, providing that there is more English waste than domestic EfW capacity, the Agency expects landfill to remain the disposal method of last resort and that the “fundamentals of the market will not change significantly”.

But, if English waste generation falls to the point where there is enough domestic EfW capacity to handle it all “then the functioning of the market will change”, according to the report.

It adds: “It is already clear that foreign EfW plants, especially in the Netherlands, can run at lower gate fees than they are currently charging. If English landfill ceases to be the disposal route against which they set their costs, foreign EfW plants would simply move to benchmark themselves against the next most expensive option, which is likely to be newly built English EfWplant.”

Exchange rate

The report also found that the effect of exchange rate changes “appears to be too small to have a major influence on market decisions during price negotiations”, adding that the drop in oil prices is also unlikely to have had very much impact on the market.

In addition, the Agency sought to address the reasons for short-term fluctuations in exports from month to month, but its report concluded that “no clear reasons” for this were found.

The report states: “This understanding of how the RDF export market developed will help the Environment Agency and Defra devise an outline of where the market might go in the future so as to inform future approaches to regulation of this waste stream.”

Funded by the Agency’s evidence directorate, the report was overseen by project manage Matt George and is based on evidence from industry sources and ‘basic qualitative analysis of the English RDF export market’.

As at least 80-85% of total UK RDF comes from England, the report treats all the datasets as if they cover just England.

For the purposes of the report, RDF is defined as material that is produced from waste, has undergone some sort of treatment process and is intended for use as a fuel.

Subscribe for free