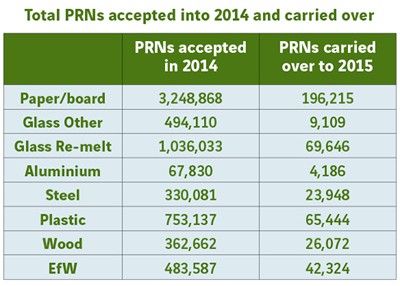

The Q4 figures for September – December 2014, which are available on the National Packaging Waste Database, also show a large carry over in glass and a ‘healthy’ excess in plastics PRNs at the start of 2015.

It follows a year in which obligations for the amount of packaging material accepted or exported were met ‘comfortably’, with plastics PRNs selling at between £5 and £7 per tonne in December 2014, and glass PRNs around £10 per tonne.

The latest figures show over 269,000 tonnes of glass remelt was accepted or exported in Q4 against a quarterly target of around 250,000 tonnes, while 69,646 tonnes were carried over into 2015.

In contrast, around 13,000 tonnes were carried over in the final quarter of 2013, following a year in which glass remelt demand caused a spike in PRN values at an estimated £80 per tonne.

The figures also painted an optimistic picture for plastics, with 213,866 tonnes accepted or exported in the final quarter – compared to 191,569 tonnes in the same quarter for 2013.

Plastics packaging comfortably met the quarterly obligation of 194,780 tonnes. Meanwhile, just over 65,000 tonnes of plastics PRNs were carried over into 2015.

However, the picture for the steel market was less promising. The material met its obligation of 87,500 tonnes with 115,483 tonnes accepted or exported in the final quarter. But there was a modest carry over of 23,948 tonnes.

In total, 1,036,033 glass remelt PRNs, 753,137 plastic PRNs and 330,081 steel PRNs were accepted in 2014.

Caution

Commenting on the Q4 figures, Ian Andrews at the Environment Exchange took a cautious view of what the carry over could mean for the 2015 market.

He said: “The figures are very good but this only gives us a snapshot of what happened in December 2014. So it doesn’t give us a reflection of what’s happening at this moment in time.

“If you looks at this year’s market we can see the better prices were being offered in the 2015 market at the end of last year, whereas in 2014 all the demand was coming out of the previous year.

He continued: “The amount of plastics carried over is only about one month’s production, and exports through January and February have apparently been very poor. Some sellers are active because they export to different markets other than China, but the Chinese market is very poor at the moment.

Steel

“The message from steel at the moment is one of concern. Available material in the UK market is very weak, and the carry over is too small to suggest the price will crash as a result of these figures.”

Chris Taylor, of compliance scheme Clarity Environmental, gave a similar appraisal of the plastics figures.

He said: “We are looking at a carry over in plastics which is similar to 2013/14, but this year’s price sits a lot lower than last time so will that have an effect on the price of the materials? At worst it will stay the same but at best it could slip down a bit.”

And James Piper, commercial director at ecosurety, said: “It is great news for producers that the 2014 obligations have been met and created a healthy carry in position for 2015. This should lead to an immediate decrease in price across the more volatile materials, particularly welcome for producers with high plastic obligations.

Q1

“However, it is debatable how long this will last for as we move into a difficult year for plastic PRNs, the Q1 figures, released in the coming months, will give us a truer picture on whether these positive figures are enough to retain the sustained lower price that producers are looking for.”

Subscribe for free