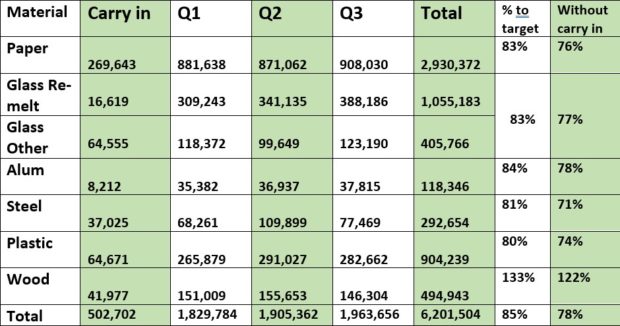

The data, released yesterday (24 October), shows that all materials are on track to hit their respective recycling targets, on the basis they have recorded at least 75% of the overall obligation once carry-over from 2021 is considered.

This comes after data for the first two quarters sparked fears that various materials would miss their targets (see letsrecycle.com story).

However, there are concerns that a number of large companies are yet to submit data, which could mean the obligation rises and percentages change. This is thought to be causing growing frustration in the market.

Without carry-in, steel and plastic are below the 75% threshold, as outlined below.

Market response

Tom Rickerby, head of trading at the Environment Exchange (t2e) PRN trading platform, told letsrecycle.com that the “highly anticipated data” delivered “just about enough hope” that targets could be met.

However, he added: “Accurate supply and demand modelling is being made more challenging by the protracted absence of significant producers in the obligation data.

“If targets are to be met this year, it is likely to be by the tightest of margins, whilst strong economic headwinds in the final quarter may yet blow 2022 compliance off course for some materials.

“Expect choppy conditions in the PRN markets for the remainder of the year.”

On the general market reaction to the figures, he added: “General recycling supply concerns saw paper PRN prices rise 12% to £33.50 with the wood market following suit.

“Plastic traded up to a year high price in the spot, rising 8% to £351 per tonne, whilst steel PRNs rebounded to £80 as its supply collapsed 30% on the previous quarter.

“There was some good news for producers though, as glass remelt and aluminium extended their recent downward price trends, falling 8% to £160 and 24% to £85 respectively on an improved supply picture.”

‘Stabilisation’

Martin Trigg-Knight, director of compliance services at Clarity Environmental, and chair of the Packaging Scheme Forum, explained to letsrecycle.com that the interim quarterly data for Q3 shows “strong progress for the metal’s grades of steel and aluminium”, and stronger production of glass remelt. He said this “goes some way to making up the shortage of glass aggregate”.

Mr Trigg-Knight added: “As a result, we’ve already seen some stabilisation of glass PRN prices. For those who are heavily obligated for glass, it will be good to know that the high PRN prices in the second half of 2022 have had an effect in stimulating glass recycling and are assisting progress towards target.

“Overall progress towards the national obligation looks tight, but is on track if we use the currently published obligation data.

“However, most in the industry are aware that there is potentially still further producer data to be added due to late registrations.

Overall progress towards the national obligation looks tight, but is on track

- Martin Trigg-Knight, Clarity

“For this reason, buyers are being cautious to ensure that the PRNs for the year are secured. This is particularly the case with plastic, which has seen a slight rise in price again in recent days.”

‘Fascinating’

Paul Van Danzig, policy director at the compliance scheme Wastepack, said the figures come on the back of a “fascinating year”.

He explained that early data showed that targets were on track to be missed but the subsequent price rises boosted recycling. Now, the targets “look likely to be hit”. He added: “This is a sign of the system working.”

On the outlook for the remainder of the year, he added: “Barring a complete collapse in international markets, targets should be OK and there is unlikely to be a last minute panic.

“While it is good news, of course, that the targets are set to be hit, recycling volumes are falling year-on-year.

“This makes sense with the economic downturn we are experiencing, but carry-over will be lower going into 2023, which will make next year tight. However, I can’t remember a year where this wasn’t the case.”

Subscribe for free