In tackling household packaging waste in particular, Germany has been very successful, achieving 60% and 70% recycling rates for many of the materials through the predominant “green dot” system.

As a result of the success of the green dot system, 21 other European countries have adopted it as the basis of their own compliance with the Packaging Directive, including new EU Member States. Throughout Europe, there are now 100,000 licensed packaging producers under the green dot, covering the recovery of 460 billion pieces of packaging waste a year.

But, Germany's success has come at a price. The company behind the green dot system – Duales System Deutschland (DSD) – has been criticised for the costly nature of its service, and has also faced running battles with the German government and the EU administration over the company's monopolistic tendencies.

Green dot

Germany's “grüne punkt” system was developed by not-for-profit organisation DSD in the wake of the 1990 German packaging ordinance, a law obliging manufacturers, fillers and distributors of packaging waste to take back their used packaging waste and send it for recycling.

How DSD's “green dot” system works:

- Packaging fillers pay Duales System Deutschland (DSD) a licence fee so that they can put the green dot trademark on their packaging.

- The amount the producers pay DSD depends on the type of packaging material and the volume or weight of material placed on the market.

- Householders are provided with two bins for their waste, one for normal waste and another for packaging bearing the green dot.

- DSD arranges for the collection of all material from householders' green dot bins using local collection firms.

- Recyclers enter into contracts with DSD to reprocess the packaging waste.

Under the legislation, producers are exempt from the obligations if they take part in an alternative collection and recycling scheme, such as the “duales (dual) system” provided by DSD.

The dual system sees householders provided with a second bin – often yellow – to go alongside their normal household waste bin. In the yellow bin they can place any lightweight packaging waste bearing the green dot trademark. DSD also provides centralised “igloo” bring banks for householders to deposit their paper and glass.

DSD has no collection infrastructure of its own, but uses income from packaging producers' fees to fund collections undertaken by local waste management companies or in some cases local authority service divisions.

Unlike the UK's packaging waste recovery note (PRN) system, which indirectly supports the recovery of packaging from the household, commercial and industrial waste stream, DSD is concerned only with household packaging waste.

Local authorities

In the UK, collecting packaging waste from the household waste stream has been difficult, since local authorities often prefer collecting the heavier materials of newspaper and green waste to hit their own recycling targets. But the green dot system means that local authorities in Germany do not have to fund packaging waste collections themselves – it is all paid for by DSD from producers' fees.

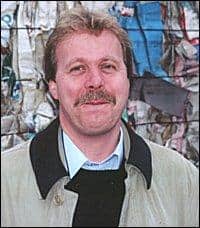

As Helmut Schmitz, head of international communications for DSD explains, “The green dot trademark is not an environmental symbol, it is a financial symbol. It indicates that payment has been made already for the recycling of the packaging displaying the mark.”

Local authorities aren't completely out of the loop, however, as many contract with DSD to undertake the collections themselves. Some also provide sorting infrastructure to be used by the DSD system, such as the Sero materials recycling facility in the city of Leipzig.

Packaging waste recovery in Leipzig

Click here to find out about the recycling of packaging waste in the city of Leipzig.

Working closely in partnership with 450 German municipalities is important for DSD, and when Germany's ban on sending household waste to landfill begins next summer, this relationship will become perhaps more important than ever.

The key to the success of the green dot has been in providing a system that is easy for householders to use – with dramatic results for DSD. During the 1990s, Germany's packaging waste recovery rates doubled, from 37.3% in 1991 to 76.7% in 2000. Up to 2003, the organisation had arranged for the recovery of 57 million tonnes of consumer packaging.

DSD is regularly surpassing the government-set recycling targets of 75% for glass packaging, 70% for paper and steel packaging, and 60% of aluminium, plastics and composite (cartons) packaging.

Costs

However, while the rates of packaging waste recovery are higher than in the UK, the DSD is expensive for producers compared to the UK's PRN system. Despite DSD making a 23% saving in licence fees in the five years up to 2003, the organisation's 18,560 members paid 540 million euros (£377.6 million) in that year. In comparison, UK producers paid just over £49 million into the PRN system in 2003.

With DSD receiving green dot fees for 4,495,692 tonnes of packaging waste, this makes for an average of over £120 per tonne, and that includes the income from recycled material. Without including the income from recycled material, DSD is responsible for 1.7 billion euros in waste management costs.

At the moment licence fees for producers using plastic packaging are 1,400 euros (£978) per tonne, for example. Compare this to the current price for UK producers under the PRN system – £15 to £17 per tonne – and it is, perhaps, clear why Germany achieves such high recovery rates.

Mr Schmitz says this only equates to about 0.01 of a euro cent on the price of, for example, a packet of whipped cream. But he also points out that the comparatively high licence fee pushes producers to reduce the amount of packaging they use in the first place.

“There has been a 14% decrease in the volume of consumer packaging between 1991 and 2000,” he says, adding that the proportion of packaging made from lightweight materials has gone up from 28% of the market to 37% of the market from 1996 to 2002.

“The green dot provides clear incentive to reduce the amount of packaging,” Mr Schmitz says, “licence fees are based on separate sale of each type of packaging material and by weight and volume. They are financially rewarded so they only save by using a certain type of packaging but also by disposing of their packaging in a responsible way.”

Unpaid

Germany's domestic breweries, such as the Reudnitzer brewery in Leipzig (above) use re-usable bottles for their products, but these can end up in DSD's bottle banks

But, the green dot licence fees are higher than they should be, Mr Schmitz says, to take account of the handling of packaging waste that arises in household yellow bins, but which does not bear the green dot. Mr Schmitz tells letsrecycle.com that up to 30% of the material collected by DSD has effectively not been paid for by their producer members.

DSD is the major compliance route for packaging producers, but represents 80% of the market. There are therefore packaging firms that comply through rival organisations, and some of this packaging is put into the green dot bins by householders.

While green dot applies to single-use packaging, householders have also been putting re-usable bottles into green dot bins. This situation has been made worse because of Germany's deposit scheme. Germany has in place a deposit scheme for re-usable bottles, to provide incentives for householders to return their glass drinks bottles to retailers to be re-used.

Recently, the government has also placed deposits on single-use packaging, at a higher rate than in re-usable bottles in order to encourage householders to opt for re-usable packaging when they buy their goods. Part of the reason for this was the lobbying power of German-owned domestic breweries, which to a large extent have long used re-usable bottles for their beers.

Mr Schmitz explains. “The medium-sized brewers in Germany lobbied the government for deposits to be higher on single-use packaging. But there has been a lot of refillable bottles in our glass bring banks because the refillable bottles are cheaper, people buy refillable rather than one-way and then throw them away anyway.”

The deposit scheme on single-use packaging has hit recycling levels in Germany – DSD revealed in its annual report for 2003 that its recycling activity had decreased by 300,000 tonnes because people were less willing to use single-use packaging. Single-use packaging producers also saw tens of millions of pounds written off their books because of the deposit scheme, and DSD also incurred a loss of income of about 300 million euros (£200 million) from the reduced use of single-use packaging.

Anti-trust

But these haven't been DSD's only difficulties in its first decade. Both the German federal government and the European Commission have raised concerns that with 80% of the market, the organisation had been set up as an effective monopoly.

The green dot will not change, but we will be the first green dot organisation that makes a profit.

– Helmut Schmitz, international communications director, DSD

The Federal Cartel Authority said that DSD was restricting competition because demand for waste management services on the part of packaging producers was being treated together. There was also concern that the board of DSD had representation from retailers and the waste industry, and was effectively a “cartel”.

The Commission objected on the grounds that DSD sells material collected through the green dot system, rather than the companies collecting the material. It also said providing a contract to a single collection organisation in each area for 15 years effectively sealed up the local waste management market. And, the Commission said that by engaging in exclusive contracts for the sorting of packaging waste, DSD was restricting the sorting infrastructure available for competitors.

As a result of these concerns, DSD has removed industry representatives from its board, is in the process of buying back shares and is subjecting its service contracts with the waste management industry to a nationwide tender procedure, a process which began in 2003. It also allowed its competitors to share waste sorting infrastructure.

Sale

But, these moves have not made the anti-trust concerns go away. In order to make sure there is no waste management cartel involved in the organisation, DSD is to be sold to a “neutral” organisation – but this will mean taking away its not-for-profit status.

“We have to sell to a profit-making company to beat the anti-trust issue. There are a lot of questions at the moment about this, but not many answers,” Mr Schmitz concedes.

A private equity firm is already in the frame to buy a 75% stake in DSD – Kohlberg Kravis Roberts (KKR), an American-owned, London-based company that specialises in the acquisition of German companies. The two organisations are in “exclusive negotiations” over a possible deal, but “the ink is not yet on the paper”.

The sale is to be the subject of a shareholders' meeting on December 13, and every expectation is that the sale will go ahead.

Mr Schmitz says: “The green dot will not change, but we will be the first green dot organisation that makes a profit. The fillers are not sure it will represent their interests as well, but there's a lot of things that are not clear.”

And, the DSD warns that other European green dot organisations could face the same anti-trust moves, saying: “I foresee that a lot of organisations will have this problem.”

Subscribe for free