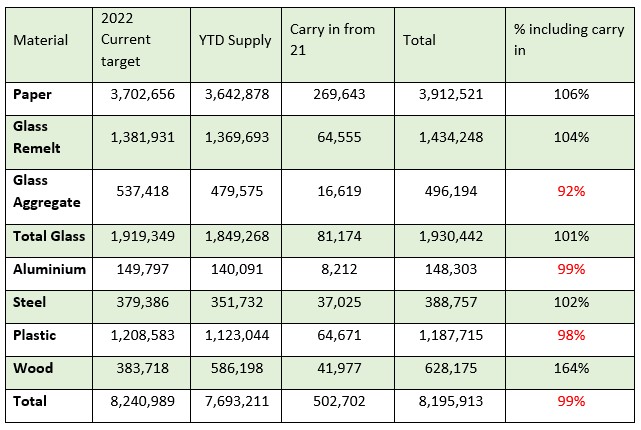

However, one specialist warned that the data shows that some materials, in particular plastic and aluminium, are in a “seriously precarious position”.

Published on 10 January on the National Packaging Waste Database (NPWD), the data is to be taken with some caution as it is compiled using monthly submissions from reprocessors, which are optional.

As outlined below, the data shows that aluminium and plastic missed targets, including with carry-in. Verified mandatory quarterly data from the Agency is due out later this year and is likely to include higher volumes.

‘Precarious’

Andrew Letham, operations manager at the PRN trading platform T2e, told letsrecycle.com that the monthly data for December was “positive in parts, with paper and steel recycling looking likely to grow significantly quarter-on-quarter, easing the general recycling situation”.

However, he said plastic and aluminium “remain in a seriously precarious position, with both needing the largest quarters of 2022, plus all of the available carry-in to hit target.”

He added: “Any transitional tonnage December generated held in 2023 could tighten markets further, particularly in plastic were we have seen good volumes begin to trade into 2023 along with paper and steel.

“Glass looks to be in a much more comfortable position buoyed by a vastly improved aggregate return and should now meet target with carry-out in to 2023.”

Aluminium

Martin Hyde, sustainability and public affairs manager at Alupro, dismissed fears that the targets will be missed for aluminium.

He said: “Voluntary monthly data is consistently behind on validated quarterly performance in the PRN system, which is ultimately how official recycling rates are calculated. We are confident that the 2022 recycling target will be met when quarterly data is published. This is in line with the performance we are seeing in the sector, with aluminium recyclers reporting a productive fourth quarter.”

Targets

One issue raised throughout the year was that the target was not clear because many producers registered late. Targets for each year are based on a percentage of that placed on the market the prior period. This data must be submitted by April.

Sandeep Attwal, group procurement manager at Ecosurety, said: “The 2022 compliance year has been challenging for several reasons. Firstly, on the demand side, the late producer registrations have resulted in extreme tightness late in the compliance year.

“This system relies on producers registering on time in April. The demand was far greater than the market expected, and this was due to the 2021 boom of consumer spending which led to a high demand for PRNs in 2022. Due to the late data submissions this was not known until late in the year.”

On the PRN supply side, Ms Attwal explained that in 2022 the slowdown started “surprisingly” in Q1, with the impact of rising energy costs, political uncertainty, freight and labour costs and more recently the impact of a consumer spending caused by inflation has made it a “challenging year for reprocessors and exporters”. In addition, the Agency’s scrutiny of waste flows and sampling and inspection plans has also led to the issuing of fewer PRNs.

She added that 2022 compliance can still be met. “However, it relies on producers not carrying December PRNs in 2023 compliance year.”

Prices

Prices for PRNs have remained high throughout the end of 2022, with many materials at near record highs with little sign of slowing.

Martin Trigg-Knight, director of compliance services at Clarity Environmental and chair of the Packaging Scheme Forum, said the figures show a tight end to the compliance year.

He added: “PRN costs for producers have been very high in the later end of this year, but that high price has been instrumental in the progress towards targets reported in this data. Amidst high energy costs, and a slowdown in demand for recycling feedstock, the UK’s PRN has helped to subsidise the recycling industry.

“Although the monthly data release shows us slightly behind where we should be, and this has stimulated further high prices on remaining 2022 tonnage, we must bear in mind that monthly data reporting is voluntary, and reported volumes are likely to increase when we see the full 2022 report.

“With the impact of recession widening, and energy costs still remaining high, we are however, likely to see high PRN prices continuing into quarter 1.”

Buoyant

Simon Stringer, managing director of Leaf Environmental, said the figures should mean that the prices drift downwards, “but it does look like they are staying relatively buoyant at the moment.”

Prices are staying relatively buoyant at the moment

- Simon Stringer, director of Lead Environmental

He added: “This may be because schemes haven’t closed off for ’22 or sellers are holding on for that last bit of value.

“It may be that in year compliance failure reflects a reported increased scrutiny of exporters. Or, it may be that the carry-in will be so small for paper and wood – about 15% of the ’23 ‘general’ requirement – that it is keeping the pressure on ’23 availability already, even though the targets are staying the same.”

Subscribe for free