Provisional data published by the EA late over the weekend showed that 318,293 tonnes of plastic was processed in Q3 (July- September 2023), described by compliance schemes as a “record”.

This was around 10% higher than the previous two quarters and boosted by an additional 20,000 tonnes of export tonnage.

While the data is provisional and could change when verified, which has happened over the years, the data has contributed to the PRN price falling by more than £100 to around £120.

Recyclers

Recyclers have told letsrecycle.com that the data has come as a huge shock to them as they have been recording that volumes are “falling off a cliff”. They added that prices have been dropping significantly as demand does. This has now been further exacerbated by the fall in PRN price.

One recycler questioned how with cheaper virgin polymer available, requirement for packaging down and the market “crashing”, how a record breaking quarter could possibly be posted.

Another reasoned that exporters have been able to send low grade material abroad to Turkey as notifiable waste and even pay a gate fee, but claim the PRN near to £300.

He said this has boosted the data, which in turn has lead to a reduction in PRN prices and will impact operations.

One plastic recycler said the fall in PRN prices could even lead to some plastic recyclers having to close plants or reduce operations, as has happened in Europe (see letsrecycle.com story).

Data

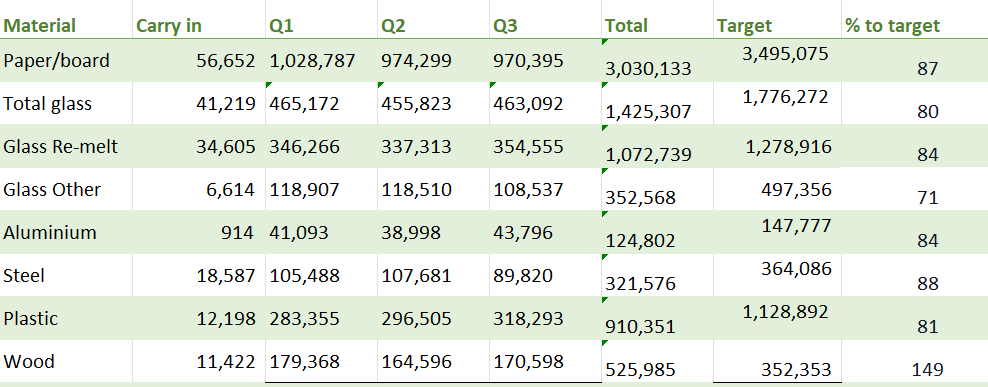

As outlined below, the provisional data on the surface looks positive, with all materials on track to be hitting more than 75% of their target after the first three quarters, except for glass aggregates.

However, along with plastic recyclers, other material reprocessors have been reporting that demand for recycled material is falling, mainly due to the wider economic downturn leading to people buying less.

Reprocessors are beginning to question the data, which at this stage remains provisional.

Tom Rickerby, head of trading at the Environment Exchange, said there is a growing sense of “incredulity” at the data.

He explained: “It’s been a busy couple of days on the t2e Exchange as the PRN market adjusts to another set of strong quarterly supply data.

“The reaction has been mixed. Another surplus quarter has left buyers with a significantly reduced risk outlook for the remainder of the compliance year and is likely to maintain the deflationary price trend across markets. However, for many sellers, there is a growing sense of incredulity at the data, as record Q3 PRN generation in paper and wood and a best ever quarter in plastic and aluminium appears to contradict weak market sentiment in secondary commodity markets and the general economic picture.

“Prices have fallen sharply on the Exchange from pre-data levels. Plastic suffered the biggest sell-off, plunging 45% to £120. Aluminium dropped 14% to £60, whilst a previously resilient glass market saw remelt and aggregate prices fall 8% and 5% respectively. Paper (£2.05), wood (£2.00) and steel (6.50) prices remain relatively unchanged having already lost the majority of their value earlier in the quarter.”

Price falls

Sandeep Attwal, commercial director at Envirovert, outlined that the figures are “surprising” given the reports from recyclers about a lack of material in the waste stream, but said it is “essential” to keep in mind that the data is unverified.

She explained soon after the data was published: “We anticipate prices falling for all materials in the near future. However, a word of caution is necessary, especially when it comes to plastic, as there may be errors in the reported data, the same goes for aluminium.

“Steel has experienced a drop in volume compared to the previous quarter. Still, thanks to the robust recycling data in H1, there’s no issue with meeting our recycling targets.

“The data indicates little to no risk of non-compliance due to supply issues. Although demand data suggests there are some producers yet to register, the market is not forecasting any significant changes in the placed on the market data. This presents a stark contrast to this time last year when all material prices were on the rise.”

Tension

Martin Trigg-Knight, director of compliance services at Clarity Environmental, added that progress towards all grades is “looking strong currently against the current obligation figures submitted to the Agencies so far”.

He noted, however, that there is still more obligated data to add that will increase the demand figure and tighten progress towards completion.

On prices, Mr Trigg-Knight added: “In anticipation of this data release, PRN prices had already begun to soften, but since data release over the weekend, prices (particularly for plastic) have fallen further (despite some in the industry raising concerns about the validity of the high volumes reported).

“Glass prices have not moved much yet, as the glass position hasn’t changed dramatically, but it is now undoubtedly more comfortable. Overall, this data set eases tension in the market considerably, and currently even looks set to provide positive carryover to 2024 obligation fulfilment across many grades. Assuming this data is accurate and representative, this shows the PRN system working in the way it was designed to – the high prices in the earlier part of the year stimulating recycling with the eventual effect that volumes increase and prices soften again.”

Subscribe for free