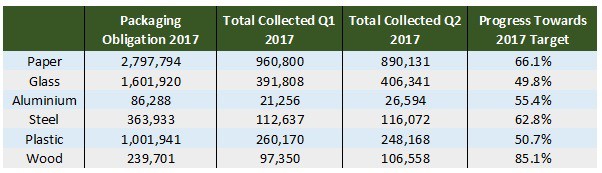

The Quarter 2 packaging data, published on the National Packaging Waste Database (NPWD) website last week, shows the overall volume of material collected to meet targets during the three months from April to June.

These follow on from the release of figures published in April for the first quarter of the year, which showed that the collection of packaging materials collected during that period had increased when compared to the same timeframe 12 months earlier (see letsrecycle.com story).

In particular, the performance of paper and plastic have been under the spotlight, due to reported difficulties in exporting some mixed grades due to a crackdown on material quality in China.

On target

However, despite concerns that this could hamper overall progress towards targets, the 2017 performance appears to have been relatively unaffected, with both paper and plastic on course to meet their respective goals based on tonnages collected to date.

For paper, in excess of 890,000 tonnes of material was collected for recycling, with around 556,976 tonnes of this exported overseas for reprocessing and 333,155 tonnes processed in the UK. However, whilst export remains the primary outlet for material, when compared to the same period 12 months earlier, the overall proportion of material processed domestically has risen.

In plastics, the figures indicate a total of 248,168 tonnes of material was collected during 2017 Q2. Of this, the bulk (153,948 tonnes) was sent for processing overseas, with a smaller proportion recorded as having been processed in the UK (94,219 tonnes). This represents a slight decrease on the overall volume of plastics collected during the same period in 2016, but the figures suggest that a greater tonnage of material was processed in domestic facilities.

PRN

As a result of concerns in the market over available outlets for plastic scrap, packaging recovery note (PRN) prices for plastic, which are traded to demonstrate that packaging producers have paid for the recycling of their products at the end of life, have witnessed a spike in recent weeks, nudging above the £60 mark in the last month.

According to Chris Taylor, commercial director at the producer compliance scheme Clarity Environmental, despite the positive performance of the material in the Q2 figures plastic PRNs may still remain at a high price as traders remain cautious over the future viability of some markets.

He said: “The performance of plastic recycling was eagerly anticipated by the industry, with PRN prices having risen sharply in recent months. The high prices appear to have driven plastic recycling enough to keep it at the levels required for the time of year, and now at 54% of its annual recycling target, many will hope that prices will start to fall away.

“Overall, the data is fairly positive and should help to reduce any further volatility in the recycling market, but a softening of plastic PRN prices may not be immediate.”

Mr Taylor said that suggestions that China may be set to ban the import of some grades of plastic and paper may need to be ‘watched closely’ to gauge a future impact on packaging targets.

For other materials, including glass, aluminium, steel and wood, targets look largely on course to be met, with tonnages collected having increased during the second quarter of the year.

Speaking to letsrecycle.com, Tom Rickerby, senior market operator at The Environment Exchange, said there were ‘no real surprises’ in the data and that compliance with targets would be ‘a formality’ for some materials by the end of the year.

He added: “Overall I think it was an excellent result for plastic.

In regards to what this means for compliance for the rest of the year, Mr Rickerby explained: “For some materials it’s a formality. But there’s still a lot of threat from China, and there’s still huge uncertainty. The issue leads to lack of confidence in markets.

“We’re on track to meet compliance but it is changeable, because of the situation in China.”

Subscribe for free