The price reductions have come despite the fact that arisings of recovered paper – or waste paper as it is commonly known – are very low. Merchants and waste companies are reporting lower volumes coming from local authority contracts and from the wider retail sector.

All this is against a background of turmoil within the paper mill sector itself with more closures and downtime reported around the world. Coupled with a slow Chinese economy and weak economies in Europe, there is an overview that the demand for new cardboard will remain low in the short term at least.

However, despite the current weak demand, there remains a little optimism that the market could be seeing signs of levelling of and that late summer might even see demand edge up.

PRNs

On the domestic market, the value of used cardboard fell below the £90 per tonne level in the UK this month with the PRN (packaging waste recovery note) having a big influence. The value of the PRN, which is used as evidence under the UK’s packaging waste system has proved volatile and has reached £35+ but more recently has fallen to below £15.

More paper PRNs were issued in the first quarter of this year than expected but it is thought that the higher prices for PRNs will have prompted better recording of paper recycling as well as more firms becoming registered to issue the evidence.

Production down

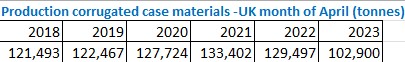

Data from the Confederation of Paper Industries (CPI) shows the decline in activity at UK mills. For 2023 compared to 2022, the latest CPI report shows that the production of cardboard over the months January to April was down 15.7% with a particularly sharp fall in April of 20.5% compared to last year. In parallel, the intake of recovered paper at mills fell by a similar amount in April.

The April production figure was the lowest for five years or more for that month and is likely to have been one of the lowest recorded. The chart shows the difference since 2018.

Demand

Issues dominating the sector were voiced by exporters and domestic businesses.

Pankaj Chowdhary, managing director of Ekman Recycling UK, explained that it is “all about mill demand and reductions in pulp prices.”

Mr Chowdhary said: “There is some demand in South East Asia, but overall it is down and in particular India is looking at lower levels. In India there is overcapacity and this has been impacted by downtime in China.”

He added that it was possible that the bottom of the market could be in sight but that export markets remained difficult. “Indian mills are facing low export demand for material and high energy costs. For example, one mill we deal with has a machine which was producing 30,000 tonnes a month and is now only making 13,000 tonnes a month.”

Colin Clarke, managing director of Winfibre UK, a major exporter to South East Asia, also spoke of the downward pressures on markets.

“We have an uneasy picture between low generation and low demand”

Colin Clarke

Winfibre UK

“We have an uneasy picture between low generation and low demand,” he said. “One bright spot might be that we are going into the summer months ahead of the last quarter which is traditionally a busier time. But, for now Chinese mills are able to source enough material from local collectors, so they have no need to acquire recycled pulp from India and South East Asia.”

Domestic

Domestic perspectives came from IWPP Ltd and a London merchant.

Chris Burton, managing director of IWPP Ltd, the trading arm of the Recycling Association, said: “The markets are on a knife-edge, and I think they could go either way. Some may say they are pointing downwards but because of low supplies, one small wiggle in the marketplace and an uplift in prices could happen. There is so little material around and we are heading towards the busier time of the year.”

Mr Burton added that he felt July will be the “flag in the sand month as at the moment the sector still can’t really tell where the year is going”.

Graeme Coombs, head of special projects at London-based recovered paper merchants Pulp Friction, said: “We seem to be in the eye of the perfect storm. Demand across the paper sector has fallen to alarming levels, not just in EU markets, but also in India and South East Asia too.”

“Demand across the paper sector has fallen to alarming levels”

Mr Coombs continued: “While we have been complaining for months about below average recovered paper generation levels, the fact that they remain at a low ebb is probably a good thing, because if production and stocks were higher, the selling prices would probably have fallen even further. Regrettably we have no option but to pass the price reduction down the supply chain to the producers.”

Mills

Signs that further turbulence will impact sales of recovered paper markets came in mid-June with the news that a major production mill at De Hoop in the Netherlands is set to be closed by Stora Enso. Announcing the proposed closure in the final quarter of the year, Stora cited the “current market environment” and noted that the De Hoop site, part of the De Jong Packaging acquisition in 2023, has a total annual capacity of 380,000 tonnes of board of various types. The plant takes in some recovered fibre from the UK.

In contrast and on a brighter future note, is that new machines in Europe are coming on stream. Earlier in June VPK Group announced that at its site in Alizay, France which it acquired in June 2022, 200 million euros has been invested to convert the existing paper machine into a recycled paper production unit “based on carbon-free energy”. The Normandy mill will use 550,000 tonnes of recovered fibre a year.

The Alizay hub realises a strong circular concept. On an annual basis, the site will reuse 550,000 tonnes of recovered paper coming from a 250-km radius around the mill, minimising CO2 emissions from production and transport. In turn, a biomass boiler and a water treatment plant produce green energy used during the paper production process.

UK

The UK itself is one location where a former newsprint site is to become a cardboard site. This will be the case with the opening of the Eren Paper mill in Shotton at the end of 2024 replacing the former UPM newsprint operation at the North Wales site. This will mean that the UK has five major board mills, the others being DS Smith at Kemsley; Saica at Partington; and Smurfit Kappa at Snodland and Nechells.

Further change within the UK market has not been ruled out. Only recently DS Smith announced a consultation on closure of most of its recycling depots and this is thought likely to happen this autumn. The company is thought to obtain most of its tonnage from the retail sector and so has less need for its depots.

Subscribe for free