OPINION: The packaging recovery note (PRN) has been pretty much unchanged for over 25 years. As a market-based system, it has provided low-cost compliance for producers compared to most of Europe, but it is not without its weaknesses. Concerns about fraudulent activity, volatility, dependence on exports, short-termism, lack of transparency and profiteering have always hung over the system, but it has broadly been accepted across industry as the most cost-effective way of meeting recycling targets.

PRN price prediction is exceptionally hard to navigate and speculate in this current regulatory and economic climate. Rarely do prices reflect logic but this year, there are issues that will make the market more uncertain than we have seen for a while.

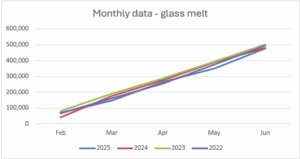

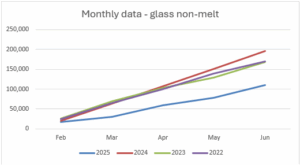

The monthly data provides useful trends, but generally, the market relies on the legally submitted quarterly data to forecast price change. The current relative stability of PRN prices reflects the most recent quarterly recycling data and the producer data, broadly indicating a degree of confidence that targets will be met. However, the monthly data for glass is highlighting a potentially critical problem.

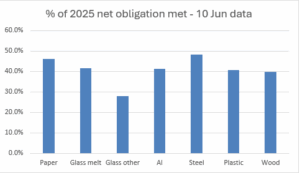

At this stage in the year, it would be hoped that the monthly data would indicate a recycling level of around 40% of the likely demand, but the graph below shows that glass is well below this figure.

Breaking the monthly glass data down, whilst glass melt is largely on track with previous years, for non-melt, it has fallen considerably behind to a point where the target seems to now be unattainable.

In addition to the current recycling levels, it is also necessary to look at the potential impact that the EPR changes will apply to the packaging recycling sector in 2026.

Joseph Doherty, managing director at Re-Gen Waste, said: “The recycling industry is entering choppy waters with difficulty in PRN price prediction, declining non melt glass recycling rates and EPR impact on reprocessors and exporter accreditation. It will require a steady hand at the helm.”

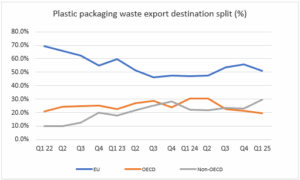

Perhaps the most significant of these will be the requirement for exporters to demonstrate that material has arrived at its destination before evidence can be issued. Q1 2025 recycling data received under FoI showed that 29.4% of plastic went to non-OECD countries and nearly 20% to Turkey. With much of non-OECD shipping taking two to three months and even Turkey taking a month for delivery, this suggests that up to 40k tonnes of plastic PRNs will be missing in Q1 2026. For paper, where 83% of exports went to non-OECD countries in Q1, this suggests that up to 600k tonnes of PRNs will be missing in Q1 2026. These PRNs will eventually come to market in 2026, but PRNs for packaging waste exported to some of these countries in Q4 will not be able to be claimed until they reach their destination in 2027.

This change will affect other materials to a much lesser extent, but it points to December PRNs being much in demand for 2026 to bridge some of the gaps, therefore adding pressure to this year’s PRNs where current recycling levels are tight in relation to PRN demand.

There are other factors to consider for 2026. EPR applies significant changes to reprocessor and exporter accreditation that may reduce both applications and approvals. Fit and proper person tests will give greater powers to the regulators to refuse applications from high-risk operators. Application fees will be considerably higher than in previous years. Reporting requirements will be much greater and data much more transparent. And for exporters, cash flow will become more critical. For an exporter to Malaysia, for instance, they may have to wait three months from purchasing the material to being able to sell the PRN.

Defra has been looking at options to smooth the transition, but this late in the year, it seems unlikely that any changes could be introduced without severely distorting the PRN market.

Whilst the focus for producers for the rest of 2025 will be the waste fee cost, sight should not be lost of the potential for PRN costs to rapidly escalate if steps are not taken to ensure that targets can be met both this year and next.

Subscribe for free