The NAO – which scrutinises public spending for parliament – made the assessment today (26 April) as the body published its investigation into government’s actions to combat waste crime in England.

The investigation was launched in response to concerns “expressed by MPs about government’s oversight of the waste industry and how action is taken to address illegal activity”.

According to the NAO, the MP’s concerns related partly to a HMRC investigation into suspected systematic abuse of the landfill tax system referred to as Operation Nosedive, “which cost more than £3 million but ended in plans to pursue prosecutions being abandoned”.

Other findings from today’s report include:

- The Environment Agency and the Department for Environment, Food & Rural Affairs (Defra) do not currently have the data they need to understand the full scale of waste crime

- A large increase in landfill tax rates has increased the potential financial return to criminals

- The Agency believes there is widespread abuse of permit exemptions

- Reported fly-tipping incidents have been increasing over the past decade

Landfill tax rates, which currently sit at £98.60 per tonne, have been set at a high rate to encourage recycling and is set to rise further in line with inflation.

The report notes that HM Treasury is currently reviewing landfill tax to ensure the tax continues to support the government’s environmental objectives.

Organised crime

The review found that a consequence of landfill tax has been to increase the attractiveness of the market to organised crime, with very few barriers to entry.

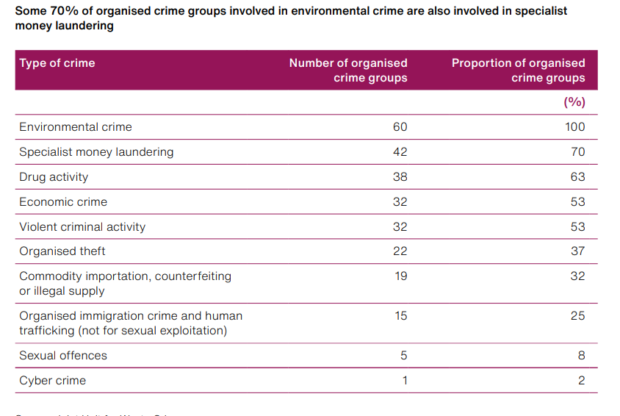

“Intelligence-sharing” by environmental agencies across England and the devolved nations “has improved understanding of the involvement of organised crime groups in waste crime,” the report said.

Of the 60 organised crime groups monitored for environmental crime (which includes waste crime) across England,Wales and Northern Ireland, at least 41 operate within England.

As outlined below, they were also heavily involved in other types of crime.

Actions

The report examined the most common actions that the Agency takes in relation to illegal waste sites and found issuing advice and guidance (52%) and sending warning letters (37%) were the most common.

The Agency’s response to investigations into breaches of environmental permit conditions and major fly-tipping incidents follows the same pattern.

The number of times the Agency has prosecuted organisations for waste incidents has dropped from a 2007-08 peak of almost 800, to around 50 per year in the period running up to the start of the COVID-19 pandemic, the report added.

Suggestions

The report made a number of suggestions to the Environment Agency including:

- Improve data on waste crime and strengthen understanding of the resources being used to tackle it

- Better understand the relationship between landfill tax rates and the incentives to commit waste crime

- Put progress indicators in place for the waste crime elements of the Waste and Resources Strategy as soon as possible

- Make use of data from police databases and systems to enhance intelligence gathering.

- Establish a more stable footing for the Joint Unit for Waste Crime’s funding

Useful links

NAO report – Investigation into government’s actions to combat waste crime in England

Subscribe for free