And, landfill tax made up over 75% of contributions to pollution and resource taxes in 2014, which as a grouping comprised 3.4% of the total environmental tax revenue generated for the year.

Energy taxes, including the fossil fuel and climate change levies, made up 72.9% of all environmental taxes – while Transport contributed the remaining 23.7%.

The figures were published by the Office for National Statistics (ONS) today (June 1), which shows a total £44.6 billion of environmental tax was generated in 2014.

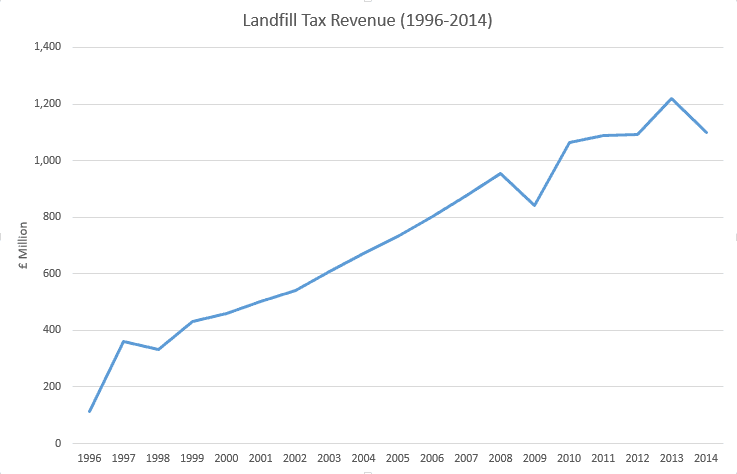

The statistics show that landfill tax revenues are now at £1.1 billion compared to £113 million generated when the regime first came into effect 19 years ago.

The landfill tax was initially set up to help divert waste from landfill and drive waste further up the waste hierarchy to incentivise recycling and energy recovery investment.

Dip

However, the figures also show that revenue actually dipped slightly in 2014 following the record £1.2 billion generated from landfill tax in 2013.

This represents the first time that landfill tax revenue has dropped since 2008/09, when income fell from £954 million to £842 million.

The decline is likely to be the result of the Treasury’s decision to remove the landfill tax escalator in the 2014 Spring Budget – which had been in place since the tax was set up.

The levy, which under the escalator had previously risen by £8 per tonne each year, now rises in line with inflation – with the standard rate and lower rate of tax increasing from £80 to £82.60 per tonne and £2.50 to£2.60 per tonne respectively in April 2015 (see letsrecycle.com story).

The latest ONS figures could reignite the debate over where landfill tax revenue should be spent. In May, the Local Government Association (LGA) reiterated its call for the Treasury to redistribute the receipts back to councils to reinvest in waste infrastructure and offset the impact of the tax on their budgets (see letsrecycle.com story).

Devolution

It is also remains to be seen what further devolution powers to Scotland and Wales could mean for income and distribution of landfill tax revenue in the near future.

At present, the Scottish landfill tax – which was transferred to the Scottish Government in April – remains in line with the rest of the UK. The Welsh Government is also consulting on how its own landfill tax powers should be implemented when the powers are transferred in April 2018.

Last week, the Chartered Institute of Taxation warned that the Welsh Government should ‘tread carefully’ on how it administers the tax and argued landfill operators may not want to see major changes (see letsrecycle.com story).

Subscribe for free