And, the government is planning to legislate to ensure that certain specified uses of material on a landfill site tax will be subject to tax following a landmark court case last year involving Waste Recycling Group.

Minsters are also to consult on how to modernise landfill tax legislation in the long-term.

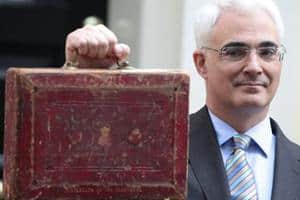

Delivering his Budget in the House of Commons, the Chancellor revealed that the Landfill Tax duty for active waste would rise by £8 a tonne on April 1 each year from 2011 to 2013. Before today, the Chancellor had not indicated exactly how much it would rise beyond next year.

The lower rate applying to inactive waste will be frozen at £2.50 per tonne for 2010/11. The Aggregates levy will also be frozen at £2.00 per tonne for 2010/11 in light of the downturn in the construction market.

The continued rise in Landfill Tax is expected to be broadly welcomed by the waste and recycling sector, with many companies urging for more clarity over the future level of the tax earlier this week (see letsrecycle.com story).

Explaining the move in the Budget report, the Treasury said: “By increasing the costs of sending waste to landfill, the tax encourages use of, and investment in, sustainable alternative treatment options, such as sorting machinery, recycling and anaerobic digestion.”

“Budget 2009 announces that the standard rate of landfill tax will continue to increase by £8 per tonne on 1 April each year from 2011 to 2013, so that tax continues to incentivise investment in more sustainable alternatives to reduce reliance on landfill, delivering emissions savings equivalent to 0.7 MtCo2 per year”, it added.

Finance Bill

However, the government also revealed that from September 1 2009 it will ensure that, through legislation in Finance Bill 2009, certain specified uses of material on a landfill site will be subject to tax and will remove “redundant” provisions.

This follows a court case in 2008 between Waste Recycling Group and Her Majesty's Revenue and Customs which has paved the way for companies to potentially gain millions of pounds worth of refunds for tax inadvertently paid on inert materials “put to good use” at landfill sites.

Consultation

The government also said it was launching a consultation on reforms to modernise Landfill Tax legislation.

The Budget report said: “In addition, the Government is assessing the case for introducing further restrictions on the landfilling of biodegradable waste and recyclable materials. Targeted restrictions on landfill could be a cost-effective means of achieving carbon energy savings from waste.

“Defra and the devolved administrations have commissioned further research on the options for such restrictions in the UK, including the costs, benefits and practical implications. The government aims to consult on these options at the end of the year.”

Landfill Communities Fund

The Budget also confirmed that the maximum amount that operators can claim against their annual landfill tax liability for contributions towards the Landfill Communities Fund – which supports environmental and community projects – would “remain unchanged at six per cent”.

The Treasury said: “This should result in a £2 million increase to bring the value of the fund to £72 million of credit claimable for 2009-10.”

Carbon

Mr Darling explained that the Budget 2009 was the “world's first” carbon budget and committed Britain to reducing carbon emissions by 34% of 1990 levels by 2020, to help give industry certainty in developing low-carbon technologies.

This target corresponds with the recommendation set out by the Committee on Climate Change last December (see letsrecycle.com story), and involves budgets being set for 2008-12, 2013-17 and 2018-22.

However, the exact details of how the government plans to achieve this reduction achieved are not expected to be made clear until it publishes its energy and climate change strategy this summer.

The Chancellor also announced an extra £1 billion to help combat climate change by supporting low carbon industries and £405 million to encourage low carbon energy and advanced green manufacturing.

He said: “Green technology will be one of the great growth sectors in the world economy. In preparing for the future, Britain’s economic recovery must be sustainable and protect the environment.”

Mr Darling also outlined support for power plants which also generate heat, otherwise known as combined heat and power.

He said: “The new generation of power plants could be even more efficient by using the heat produced in the generation of power. To encourage the use of Combined Heat and Power technology, I will exempt those projects from the Climate Change Levy from 2013 – bringing forward over £2.5 billion in investment.”

Scrappage and AD

Other main announcements in Budget 2009 include a vehicle scrappage scheme for old cars and vans (see letsrecycle.com story) and a £10 million fund to support the development of anaerobic digestion and in-vessel composting capacity (see letsrecycle.com story).

Subscribe for free