Engie said it would study the Veolia proposal “in the coming weeks” and would make sure it got the most attractive offer for its Suez shares. Engie currently owns 32% of Suez.

‘Confidence’

Suez reacted strongly to the announcement, although it did not appear to reject the idea of a bid directly. The company said it “unanimously reiterated its full confidence in SUEZ’s strategic project that will create significant value for SUEZ as an independent company”.

If Veolia acquires the 29.9% stake in Suez and then submits its tender offer for the rest of the company, it will need to acquire a 66.7% stake (just more than two thirds) for the deal or “merger” to happen.

Merger

Previously, on Bloomberg video in 2018, Suez chairman Jean-Louis Chaussade said a merger with Veolia “would not create any value, it would destroy a lot of value, because we will have to sell a lot of assets.” And, he also claimed it would “not be seen as reasonable politically in Europe and France.”

“It would destroy a lot of value”

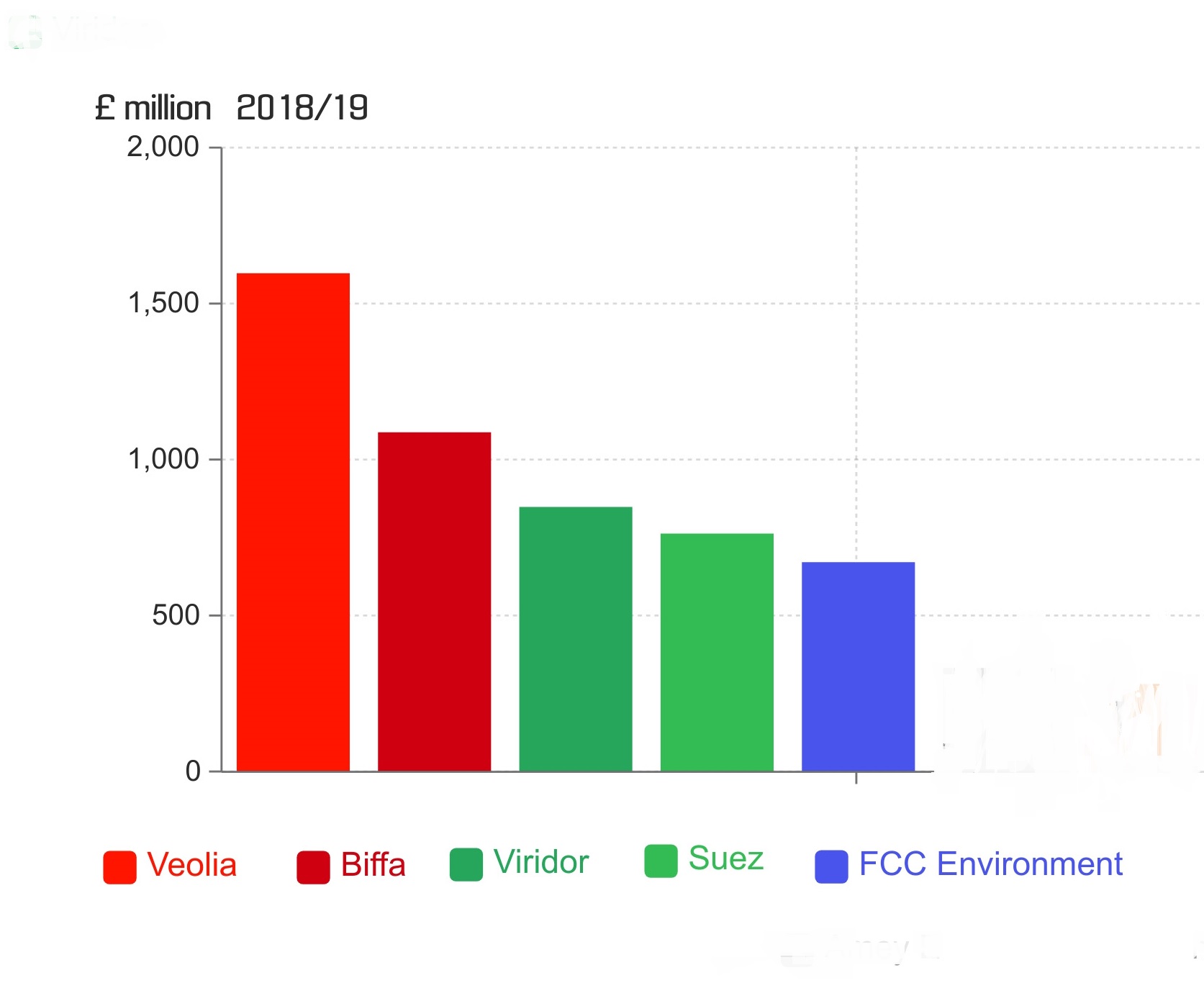

Worldwide, Veolia employs 179,000 people while Suez employs 89,000. In the UK, the pair have a range of infrastructure including energy from waste plants and recycling facilities. They are strong in the commercial and industrial sector; on the municipal front, Veolia is thought to have a higher number of collection contracts than Suez. The table below shows the estimated positions of the business in terms of UK top five companies. To some extent, in terms of infrastructure such as energy from waste, Suez and Veolia have facilities in different areas of England.

Reactions

Within Veolia UK the decision on what happens in wake of the approach to acquire Engie shares is seen as a move which will be handled in France. However, in the UK, Mr Graveson said on Twitter: “We’ve been presented with a huge growth opportunity to bring Veolia & Suez closer together to deliver customer solutions for a #ecologicaltransformation whilst minimising the impact of human activities on our planet, and leading a global green recovery.”

We’ve been presented with a huge growth opportunity to bring Veolia & Suez closer together to deliver customer solutions for a #ecologicaltransformation – whilst minimising the impact of human activities on our planet, and leading a global green recovery https://t.co/TWjPr4RVBR

— Gavin Graveson (@GavinGraveson) September 2, 2020

Mr Graveson is likely to know Suez well, not just from it as a major competitor but also because he worked in the past for Suez Recycling and Recovery UK as a director – the latest name for the original S.I.T.A. (GB) where he worked 20 years ago.

The emphasis placed on “ecological transformation” by Mr Graveson reflects the heavy emphasis on the environment, which is part of the message from the company’s chairman as a rationale for the deal.

Culture

Veolia’s chairman and CEO Antoine Frérot said: “This project is part of a friendly approach, as we share the same businesses, corporate culture and values with Suez.”

“This project is part of a friendly approach”

Antoine Frerot

Chairman, Veolia

And, emphasising the future importance of the environment to companies such as Veolia, he remarked: “For ecological transformation the room is so large and there are so many things to do… This is a unique opportunity to create the world champion of environmental transformations by bringing together the men and the women of Veolia and Suez in a project which will benefit all of their stakeholders.”

After pointing to “the climate change emergency before our eyes” and the need to implement the European Green Deal, Mr Frerot said that the “the combination will accelerate the strategy of both groups, common culture and shared values, and strong value creating transactions”.

The Veolia chairman added: “This project is so exciting that I think that the Suez management will also share with us this value of the project for all my feeling is that they will join us in some few days or weeks to share it and put it in force. So, hostility for us in not really an option. It is an inclusive proposal… for Veolia and Suez.”

UK views

Speaking to letsrecycle.com, one senior UK waste management director said he thought the deal could “well go-ahead, but is also down to decisions by investment funds such as the giant investment group Amundi. This is likely to be a financial deal with an eye to environmental issues and future trends.”

Paris-based Amundi is thought to have a number of Veolia and Suez shares in its funds and is keen on environmental measures and development. It notes “responsible investing has been one of Amundi’s founding pillars since its creation”.

Disposals

Another senior waste industry director said that, in terms of disposals subsequent to the companies coming together, this had happened in northern Europe when Veolia and Suez had sold businesses to each other and others in the past.

Local authority

From the local authority side, a leading local government officer remarked that he would expect there “may be concerns on the electricity generation side because of the large numbers of energy from waste plants that would be involved.”

But he felt that a merger could be beneficial in terms of recycling: “A merger might give them some strength on the recycling side and make it easier to moderate the fluctuations in prices.”

In terms of whether the potential loss of Suez as a tenderer for UK work might have consequences in bidding rounds, he said: “I think there would be some nervousness about the implications for long term competition on infrastructure. When looking at waste infrastructure, both Veolia and Suez, what they really know counts for something. There are other suppliers but these are smaller and Veolia and Suez have a depth of resources.”

He added: “I would expect that the CMA would at least look at the implications for the UK.”

Investment sector

All parties involved in the current approach by Veolia for Engie’s stake in Suez have this week been rushing to appoint advisors. City firms contacted by letsrecycle.com said there would be large numbers of banks, funds and lawyers involved because of the size of the three “environmental and energy giants” involved in the process.

The bid for the shares surprised some analysts, but others said that it was not unexpected – the two companies are widely reported to have discussed the potential for a deal in the past, although this time around Suez said firmly that it had not been involved in discussing the Engie shares or the proposed tender offer for the rest of the shares.

The size of the potential deal was noted by Xavier Regnard, equity research analyst at investment bank Bryan, Garnier & Co. He told letsrecycle.com: “The offer is surprising since it is not in line with the strategic plan and M&A strategy presented by Veolia in February… initially Veolia was expected to make small targeted acquisitions. The transaction with Engie and Suez is way bigger and complex. It’s a €10bn deal with 5 players (Veolia, Suez, Engie, Meridiam and the French state – Engie’s reference shareholder), plus antitrust issues. Admittedly, Veolia and Suez are similar and have the same culture but it’s more challenging to integrate.

“It makes sense to acquire strength but it’s also a challenging move.”

Mr Regnard continued: “There will be anti-trust issues but Veolia has already put forward solutions for this: Meridiam for the French water side of things. It sounds like there could be a good solution, there. They have another antitrust issue with the French waste management side of things. So far they have not proposed any solution but Veolia is aware of the issue.”

Next steps

The next steps are for Engie to consider the Veolia offer and, alongside this, Suez have created an ‘ad-hoc group’ to assess the situation.

Subscribe for free