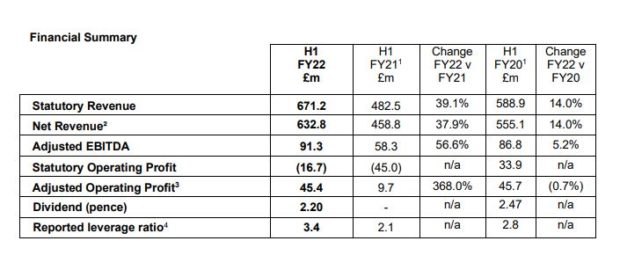

The company’s revenue climbed 14% to £671 million, compared with the same period last year, and adjusted profit has returned to pre-pandemic levels at £45.4 million.

Biffa said increased revenues and adjusted profit were down to a strong performance in collections and recycling.

However, this was offset by the “expected declining contribution from inerts and landfill gas” and some other sectors underperforming.

Biffa explained that the Company Shop Group (CSG), which it acquired in February (see letsrecycle.com story), has “underperformed”, and as a result it has booked a £25 million impairment charge.

The company’s new plastic recycling facilities at Seaham and Washington have completed their commissioning. At Seaham, Biffa is now “moving through customer acceptance phases”.

However, this process is taking “slightly longer than expected, and therefore we have sold less rPET pellet than anticipated”. Biffa said it anticipates “full acceptances in the near term ahead of the implementation of the new plastics tax in April 2022”.

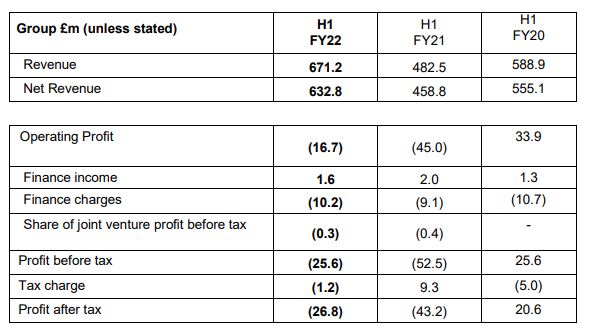

As outlined below, Biffa’s adjusting operating profit rose to £45.4 million. However, it posted a £25.6 million loss after tax (shown at bottom of article).

‘Good progress’

Michael Topham, chief executive of Biffa, said: “During the first half of the year we have successfully restored Biffa’s adjusted operating profit to FY20 levels, managed the impact of the supply chain challenges that are affecting the entire economy, and continued to make good progress in delivering our strategic priorities.

“The rebound in business performance, with volumes and pricing across most areas of the business at or above FY20 levels, is testament to the resilient characteristics of our business model and the commitment of our team.

“Whilst like all businesses we are currently experiencing some cost inflation, most of our business has a level of pricing flexibility meaning we are well placed to mitigate these pressures.”

On Biffa’s investments into circular economy projects such as plastics recycling plants, Mr Topham added: “These investments will provide the UK with essential green economy infrastructure and services, whilst giving Biffa a solid platform for sustainable growth.”

He added that the board “remains pleased” with Biffa’s performance, and as a result has reintroduced dividends.

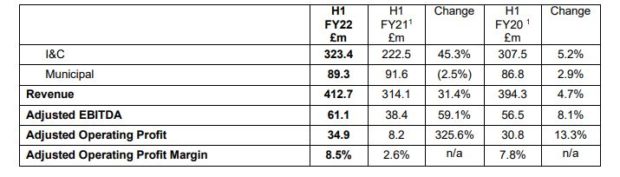

Collections

The collections division, which includes industrial and commercial (I&C) and municipal customers, saw revenues increase 4.1%.

Operating margins have improved over the same period from 7.8% to 8.5%, principally due to improved underlying performance in I&C.

I&C volumes recovered to 97% of the same period two years ago (FY20), Biffa explained, and volumes “continued to recover in Q2 and we exited the first half at 103% of the levels experienced two years ago”.

The municipal business was boosted by contract wins with Stratford-upon-Avon and Warwick councils and Biffa says, looking ahead, “the division is well-placed to support our local government customers in meeting their new obligations”.

Recycling

While Seaham and Washington have had delays to commissioning, Biffa reported good performance at its material recycling facilities (MRFs).

It also said the acquisition of certain recycling assets from Viridor “now positions us as the largest operator of MRFs and plastic recycling facilities across the UK and together with Green Circle,

significantly strengthens the raw material supply chain into our Polymers business”.

Biffa added: “In July 2021, the Environment Agency was successful in its case against Biffa regarding the export of wastepaper to India and Indonesia in 2018. There are no outstanding costs associated with the case and we do not expect ongoing exposure as prior to the conviction we had ceased exporting mixed wastepaper outside the OECD.”

EfW

Biffa’s results say that “solid progress” is being made on the construction of our two energy recovery facilities, both of which are being developed in partnership with Covanta Green.

The Newhurst facility remains on track to be delivered in 2023, with the most recent milestones including the installation of the waste grate system and boiler.

The Protos facility, which broke ground earlier this year, remains on schedule for 2024 and recently began the installation of its steel framework.

Acquisitions

With regards to the Viridor acquisition, Biffa said it is “pleased with the early trading performance of the assets acquired from Viridor on 31 August”.

Biffa said the acquisition of Viridor’s collections business is a “key step in our consolidation of the highly fragmented I&C collections market, adding c.£85m revenue (FY20), c.21,000 customers, 15 depots and c.270 vehicles to Biffa”.

The CSG however was hit by lower footfall and basket spend, especially at stores opened immediately prior to and during the pandemic, where the performance has been below expectations.

Biffa said it has seen “some improvement” in various areas of the portfolio over the last quarter and

expects this trajectory to continue as customers “return to more normalised shopping trends”.

Overview

Biffa said in its overview that it remains “well positioned to deliver our growth strategy across our four investment areas: reduce, recycle, recover and collect”.

Including the costs of the Viridor and CSG acquisitions, the company posted a loss of £25.6 million before tax, down from a loss of £52.5 million last year.

Subscribe for free