And the concerns come as the paper division president of the global trade association BIR, has described the situation as a “crisis”, asking “when will it end?”.

Some in the UK sector say that the current market could even see the material backing-up at retail distribution centres as the market worsens. For now, the latest feedback from the paper recycling sector is generally that “orders are out there”, but it “depends on what price you will accept”.

The worsening pictures relates in particular to the fact that with the Christmas retail period looming, in some places used cardboard movement could be delayed and have to be stored.

Lower grades

The crisis warning came last week from Jean-Luc Petithuguenin, president of the global trade association BIR’s Paper Division. He warned: “For the lower grades, there is insufficient demand for the available supply and the lowest grades are difficult to place in the market.”

In his quarterly report ahead of BIR’s autumn meeting this week in Hungary, Mr Petithuguenin said: that 2019 is a “pivotal year in which we are still suffering the consequences of the Chinese government’s decisions. Europe is a market of surplus; demand from the continent’s paper mills is insufficient to absorb available supply and waste management companies must export their material.”

Mr Petithuguenin added: “Also in this market, quality requirements are rising, and the current and future trend must be towards adapting our production and focusing on quality. Many controls are being established. Professionalism and traceability must be respected. We are in a downcycle, but the market will get going again. The question is how long will this crisis last?”

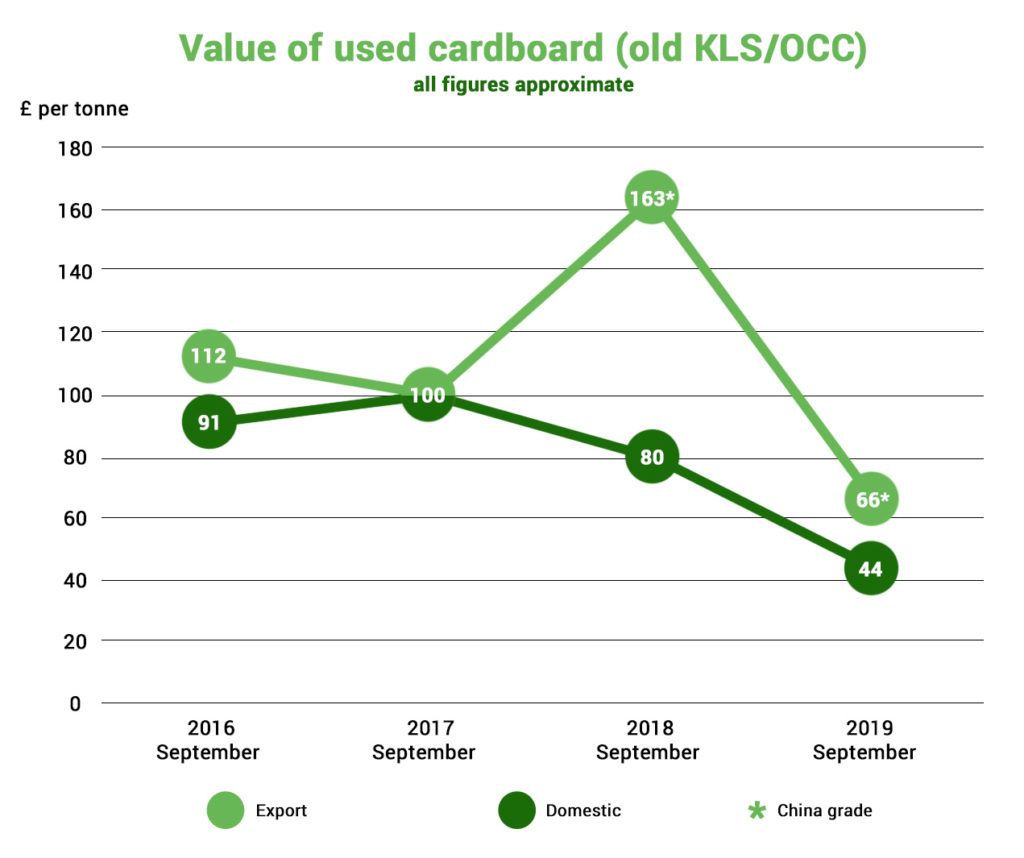

Suggestions are that this month prices are as low as £50 in the export market for used cardboard (OldKLS/OCC) with domestic mills paying below that figure. The value is down by more than £100 from a year ago when there was a boom in demand from China which had prompted significant investment by suppliers to achieve high quality standards. The recent slump in prices for used cardboard comes in the wake of a dramatic fall in orders from China with other markets taking up the material at a slower pace.

Rebates

Consequently paper recycling businesses have told letsrecycle.com that while quality remains important, “more important is that rebates are having to be cut back and charges have to be paid for bins and bin lifts”.

The two trade associations in the UK waste paper sector have also warned that the markets will be “tough” over the autumn and winter.

“The indications are that market conditions will be tough in coming months as global geo-political factors such as trade wars and slowing economies shorten demand for main grades such as OCC,” warned Simon Weston, director raw materials at the Confederation of Paper Industries.

Mr Weston continued: “This could lead some producers to have difficulty moving stock, particularly those who have exploited export markets to maximise short term revenues. Those with long term relationships with UK paper mills will still move stock, albeit at lower prices. However, watch for grade substitution as mills

switch to take advantage of high quality raw material at low prices, and for opportunities for UK fibre sales if Japanese secondary fibre supplies into China are badly interrupted by the recent typhoon.”

Waste bins

The president of the Recycling Association, Craig Curtis, said that quality still remained important. He was concerned that charges for uplifts could see some businesses opting to put recovered paper into general waste bins for later sorting by their contractors. “The danger of this is that the quality specification goes down and keeping the material separate helps us keep up quality standards.”

Simon Ellin, chief executive of the Recycling Association, said: “I think we are in for a really rough ride. China has still been driving the market but even then their demand is significantly diminished. China is now full and there are not going to be any shipments sailing from late October.”

“Keeping the material separate helps us keep up quality standards”

Mr Ellin said it was not yet known when new shipments quotas for 2020 would be issued for China. Overall, despite the low prices in the marketplace, he said: “my advice would be to sell and to keep moving stock”.

Despite the current gloom, which the sector generally expects to last for 3-6 months, there is some optimism that new plants coming on stream in 2020 and beyond will see demand for used cardboard and mixed papers rise.

Projects include Winfibre which has a new mill in Malaysia, a number of projects within Europe and action by Chinese mill groups who are responding to the country’s decision to cut back on the importing of waste paper and instead are looking at building overseas plants to produce a recycled pulp.

Last month the large Chinese mill group Nine Dragons, which has ACN, as its European supply business, commented that “In response to changes in the macro-environment and policy on the import quota of recovered paper, the Group strived to diversify the raw material sources and expanded its business downstream to establish a vertical industry chain”.

Nine Dragons chairlady, Cheung Yan, said: “We will strengthen our efforts in expanding the domestic sourcing channels for recovered paper purchase, and continue to explore opportunities to expand the production capacity of recycled pulp overseas.”

Nine Dragons has bought a Malaysian recycled pulp plant and said it “plans to commence additional production capacity of 2.05 million tpa and 0.55 million tpa for linerboard in China and Malaysia respectively, and to further increase the production capacity of its existing mills in the US for recycled pulp by 0.56 million tpa and kraft pulp by 0.20 million tpa.”

Viridor

The view that the markets will recover is also commented on by Viridor recycling chief Keith Trower, who is the UK’s representative on BIR. In his report for the trade association earlier this month, he said: “The effects of the changing paper landscape have continued to cause disruption and volatility. The sources of this include: the trade war between the USA and China, resulting in the potential for import tariffs of 5%; reduced import quotas in China resulting in reduced buying and depressed prices; and further uncertainty concerning import restrictions in the Far East, in particular in Indonesia.

“The result of this has been that the recycled paper world is continuously having to adapt and seek new outlets. It appears that India currently has the highest volume of available capacity for imports and is able to capitalise on the low global demand through offering low prices.

“However, history has taught us that out of change, disruption and volatility, there is always opportunity. This is being seen in Europe as mill groups and paper reprocessors are investing in new capacity specifically to target imports from the USA. It is likely these facilities will be located close to ports or docks to further optimise haulage and container unloading. These could be in place as early as 2020.”

Subscribe for free