Biffa posted revenues of £1.042 billion, down 10.4% from the previous year, mainly as a result of the “significant impact” felt by its collections division in the first half of the year (March – September 2020).

The company said volumes in its commercial and industrial division dropped by more than 50% compared to the prior year, “followed by a solid recovery across the balance of year, with full year volumes at 82% of the prior year”.

Biffa’s resources & energy division was also “particularly impacted” in its inerts business, which also saw volumes drop to more than 50% of prior year levels in Q1.

“Other short-term pandemic related impacts included reduced commercial food waste volumes and depressed plastic prices,” the results read.

Other factors which contributed to the loss were: asset impairment charges relating to the Poplars AD plant (£8.2 million); an IT replacement project (£13.7 million); an uplift of onerous contract provisions (£10.3 million); the decrease in the real discount rate on provisions of (£20.6 million); and an increased level of amortisation of acquisition intangible assets (£27.4 million).

Performance

Biffa added that its financial performance was underpinned by “significant support and sacrifice from key stakeholders” including dividend and bonus suspension, pay reductions for leadership, pay freezes and furlough support of £12 million for up to 1,800 employees furloughed for various periods in the year.

Due to the impacts of Covid-19 on the business, the board is not recommending a final dividend for the FY21 year.

Highlights

The company said “swift and decisive action” taken from the outset of the pandemic meant minimal disruption for customers and protecting the group’s financial strength.

It also continued strategic delivery across its four key areas, supported by equity raise in June 2020, with just over £350 million since committed and £425 million committed since the September 2019 capital markets day across its core investment areas.

The four key areas are:

· Reduce: The Company Shop Group acquisition expanded Biffa’s offering into commercial surplus redistribution and “improves our capability to support customers’ waste reduction and recycling targets”

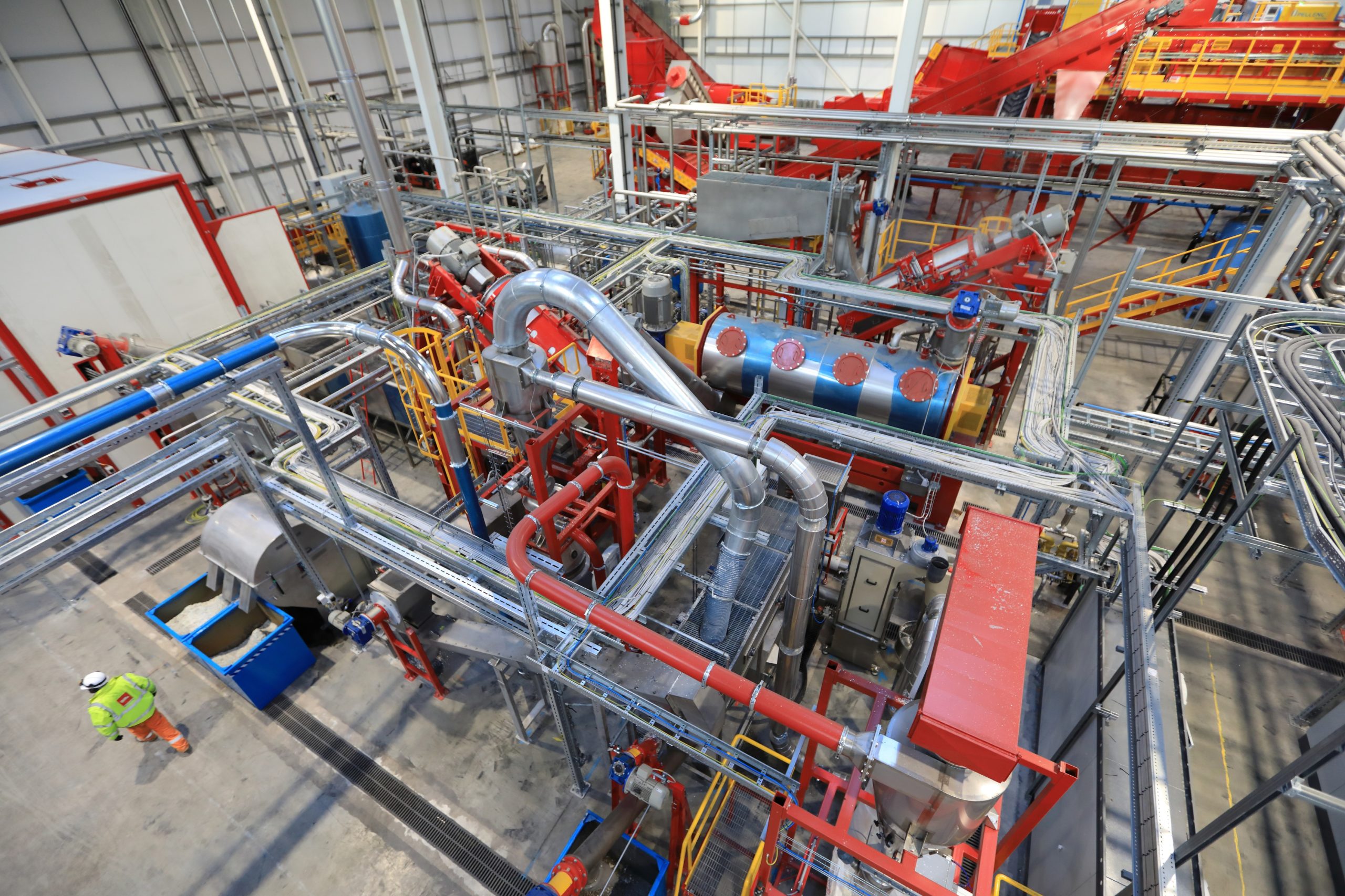

· Recycle: Progress in consolidating Biffa’s leading position in plastics recycling with additional investments in Seaham, Washington, and Aldridge

· Recovery: Newhurst and Protos energy from waste construction projects commenced and are on track

· Collect: Simply Waste and Ward Industrial and Collections (I&C) acquisitions strengthened Biffa’s leadership position in the I&C market

Strategic delivery

Its strategic delivery was also “further accelerated” by the recent announcement of the agreement to acquire the collections business and certain recycling assets from Viridor for £126 million (see letsrecycle.com story).

Biffa says it is “positioned for post-pandemic recovery with leadership positions in core markets and a well-developed investment programme, underpinned by an encouraging recent trading performance”.

“I’m extremely proud of the way the entire team responded in what has been a defining year for Biffa”

Michael Topham, chief executive

Biffa

‘Extremely proud’

Michael Topham, chief executive of Biffa, said: “I’m extremely proud of the way the entire team responded in what has been a defining year for Biffa. We were able to protect our people and continue to provide the essential services on which society depends, while taking decisive action to strengthen the finances of the group and continue to invest for the future.

“It has been a year none of us want to repeat but certainly one which showed us at our best. We are pleased to have been able to end the financial year with results ahead of our expectations. We are strongly positioned for the post-pandemic recovery with leadership positions in our core markets, a well-developed investment programme and exciting growth opportunities ahead, leveraging the Group’s unique position at the heart of the circular economy. Adding to the progress we made in the year, the recent announcement of our agreement to acquire Viridor’s collections business and certain recycling assets is another significant step for Biffa, further accelerating the delivery of our growth strategy.”

Subscribe for free