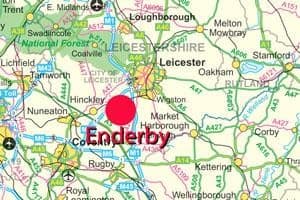

Eurokey Recycling Limited and its associated companies had achieved spectacular success in the four years prior to the May 2010 blaze at its plant in Enderby, Leicestershire.

Their turnover had increased massively from just £3.2 million in 2005 to £16.8 million for the year ended August 2009, with a gross profit of £3.7 million.

The company’s bosses were predicting a turnover of £25 million in 2010 and anticipated gross profits of £7-8 million.

However, when the fire broke out (see letsrecycle.com story), the company – which specialises in plastic, cardboard and metal recycling services – was insured by a Lloyds syndicate on the basis that its projected turnover was just £11 million.

The sum insured by way of gross profit for business interruption purposes was just £2.5 million.

The value of stock and machinery in and around the burnt out premises had also been seriously under-stated.

Under-insured

There was no dispute that Eurokey was gravely under-insured and the insurers, Paladin Underwriting Agency Limited – who had charged a £40,000 premium under the policy – swiftly raised the issue.

Paladin made a once-only offer of £1.5 million to settle the entirety of Eurokey’s claim under the commercial combined policy. Eurokey was told that, unless the offer was accepted, it would be withdrawn and that Paladin would seek to avoid the policy.

The company accepted the offer in July 2010 after taking legal advice from a QC, Mr Justice Blair told the High Court.

Eurokey argued that £1.5 million was only a fraction of the sum it would have been due had it been adequately insured. It made a number of allegations of negligence against its then brokers, Giles Insurance Brokers Limited, and claimed substantial damages.

However, in dismissing Eurokey’s claim, the judge found that the brokers had adequately explained the nature of the policy and the level of cover.

Figures

He was also satisfied that the figures for turnover and business interruption had been provided to the brokers by Eurokey’s then commercial director. The individual broker who advised Eurokey, a man with 35 years’ experience, had ‘no reason to suppose’ that the cover provided was inadequate.

So far as stock and machinery were concerned, the judge again found that the wrong figures had been given to the brokers. The commercial director could not be criticised for failing to read in detail the documents provided to him by the brokers.

However, the incorrect figures had been passed on to other prospective insurers by Eurokey itself when it was searching for cheaper insurance cover.

The judge added: “Eurokey must take responsibility for the fact that the wrong turnover figures were given to Giles, which should have been obvious from the draft accounts which it had from March 20 2010, if nothing else”.

The court heard that, following the fire, Eurokey had negotiated alternative insurance through a new broker, which included £13 million of business interruption cover for a premium of nearly £80,000.

[…] To read the full article please click here https://www.letsrecycle.com/news/latest-news/eurokey-recycling-loses-insurance-court-case/ […]