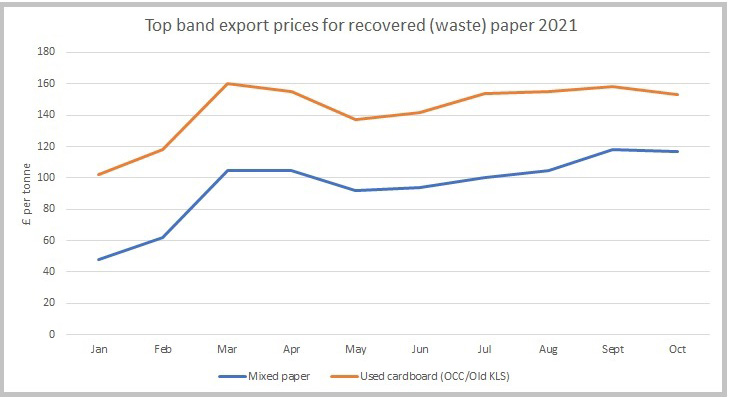

The downturn after a steady and rising year of prices, particularly for used cardboard, is seen as a sign that producers, notably in south east Asia, are finding it harder to pass prices on for finished product and that the transport costs, rising all year, are really beginning to bite. But, overall prices remain relatively high with the same applying to mixed paper.

Shipping

Prices for container shipments to South East Asia for November are being talked of as potentially $500-1,000 higher per container, with blank sailings introduced by some shipping lines and China’s Golden Week holiday also disrupting cargo movement. The Christmas production season for this region has also passed.

Consequently prices for used cardboard to South East Asia are reducing, with demand from Indonesia said to be weaker, as is the situation with Vietnam and Thailand.

There has been some relief than Indonesia’s inspection policy is allowing material to flow with a 2% contrary rate. This has been interpreted that non-cardboard paper grades can enter the country, and also items such as metal cans have not been ruled out. Nappies, however, are likely to mean loads will be rejected, one exporter remarked.

Prices for export markets for cardboard are always significant in the recovered paper market as they are watched closely by UK mills. The consequences of reductions of around £10 per tonne for the start of November are expected to be reflected by domestic mills.

Mixed

One grade, though, that has been unusually high – mixed papers – is still said to be relatively firm, although falls in value are talked of.

Mixed has proved particularly popular during the pandemic, with mills hungry for the material as it has generally contained more brown cardboard and so is a cheaper feedstock for mills to complement higher prices paid for used cardboard.

Demand from deep sea markets for mixed is expected to remain firm in November. While mills on the continent, particularly in Germany, have been competing more strongly than usual for mixed in the past two months, they are expected to reduce interest and seek price reductions of €5-10. Claims on lower grade mixed are also being seen more often.

The high value of mixed paper is matched by the unusually high prices seen for mid grades, as tissue mills seek recycled fibre for their plants and deinking mills (newsprint) also seek tonnage. The demand for office waste and printers waste paper remains strong, with short term demand outpacing supply. Observers suggest this sector is unlikely to see reductions in November, but a decline is more likely in December.

Energy

Another factor influencing the European market for recovered paper is the cost of energy. Mills have said they have been hit hard by the unexpected rise in costs and some are said to be planning downtime to save operational costs which could impact on demand in the recovered paper market.

These same mills are also actively implementing energy surcharges of up to £150 per tonne

– UK printing company

While mills are complaining about the high energy costs, some have chosen to impose levies on customers. One UK printing company told letsrecycle.com: “We have already been hit in recent months by multiple paper price increases. However, with energy prices across Europe now at unprecedented levels, these same mills are also actively implementing energy surcharges of up to £150 per tonne.”

The printing company added: “In addition to price pressures, as a result of worldwide post pandemic demand for pulp far outstripping supply, paper availability in the short and medium term is under threat, with some mills in Europe having already committed their productive capacity until the end of 2021.”

India

Another surprise issue has also emerged in the recovered paper sector this week creating the potential for some market disruption if a European Union legislative move becomes real.

Exporters of waste paper to India from the European Union were taken by surprise on 20 October, when the European Commission published its updated list around the Basel Convention export controls over what waste materials can be sent overseas for reprocessing.

According to the document, waste paper will be banned from India when the rules come into force on 8 November 2021. Many in the sector consider this to be a clerical error and likely to be resolved shortly. The rule also applies to Northern Ireland under the terms of the Northern Ireland protocol. However, it does not apply to exports of waste paper to India from Great Britain, although there is some uncertainty as to whether the rules would impact on material sent to India from the UK which transits through European ports, such as Rotterdam. The UK government has already published its export rules back in June and is not subject to the latest EU requirements – apart from Northern Ireland.

The list can be seen HERE with columns: (a) = export prohibited; (b) = prior written notification and consent procedure; (c) = no control in country of destination; (d) = other control procedures to be followed in country of destination under national law.

Subscribe for free