OPINION: The Packaging Waste Regulations require producers – those placing packaging onto the market – to be registered with their previous year’s packaging activity data by 15th April. This data gives an indication of the likely demand for PRNs but each year, there are always a significant number of producers who don’t register by the deadline.

The Packaging Waste Regulations require producers – those placing packaging onto the market – to be registered with their previous year’s packaging activity data by 15th April. This data gives an indication of the likely demand for PRNs but each year, there are always a significant number of producers who don’t register by the deadline. The data is therefore expected to grow as the year progresses. The problem is then trying to estimate the likely final obligation to assess whether there will be sufficient PRNs to meet demand.

Late registration is understandable for companies that are new to the system, but one would hope that for the companies that are used to the routine, there would be a desire to comply for reputational reasons if nothing else. Where large packaging producers register late, their missing data can have a significant impact on the PRN market. Morrison’s, for instance, didn’t register in 2022 until very late in the year leading to a sudden significant increase in PRN demand.

Lowest number

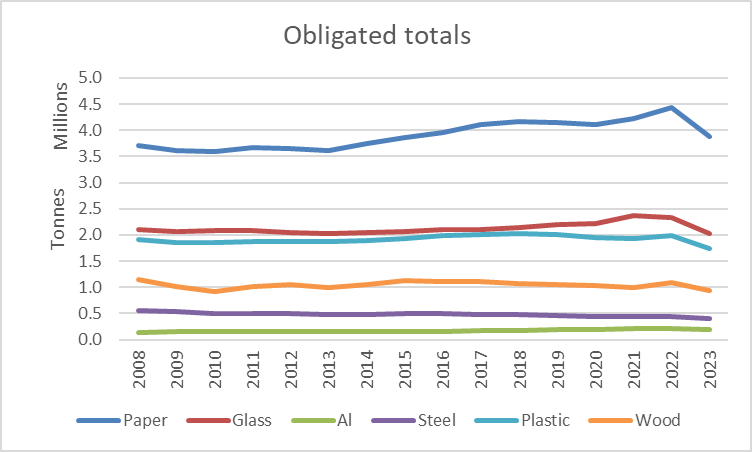

This year, we have seen one of the lowest number of producers registering on time for a number of years. The data shows that 6,211 producers registered by the deadline compared to 6,344 at the same time last year and 6,918 by the end of the year. The graph below shows the impact this has on total tonnage reported to which the targets are then applied to create the PRN demand.

There is an expectation that there may be a slight reduction in reported tonnage as economic pressures are assumed to have reduced packaging consumption in 2022. The big question is by how much? With the figures as they stand at the moment, then the Q1 recycling data would suggest that the targets will be easily met. However, if the final data reaches 2022 levels, then that Q1 data would indicate an extremely tight market with the potential for PRN prices to escalate, leaving those that need to buy PRNs with the quandary of when to buy. Further pressure could also arise through demand for the December carry forward PRNs once the targets are known for 2024.

It is expected that the new EPR Regulations will contain stiffer penalties for late registration and we can only hope that these will be a sufficient deterrent to avoid the somewhat disdainful way that many companies treat the deadline at present.

Phil Conran

director of 360 Environmental

The table below shows the percentage of the obligation that would be met by the Q1 recycling data showing the difference between applied to the producer data published on 12 May compared to the final 2022 producer data.

One of the biggest falls in registered data is the glass pack fill tonnage which is down 33% on the final 2022 figure. At the same time as publishing the data, the EA also published the list of companies that registered on time and those that were previously registered but have yet to register in 2023. For glass, this includes major drinks manufacturers Diageo and Anheuser-Busch but across the materials, there are many other well-known brands yet to register – B&Q and Unilever, for instance.

Stiffer penalties

It is expected that the new EPR Regulations will contain stiffer penalties for late registration and we can only hope that these will be a sufficient deterrent to avoid the somewhat disdainful way that many companies treat the deadline at present. The regulators have no powers to force companies to register before the end of the year. However, most of the missing companies were previously registered with compliance schemes and hopefully, they will add to the pressure to get these companies registered soon so that the PRN market can operate as it should.

Subscribe for free