For some companies the rise in the supply of electricity prices to the grid is a welcome boost. In the past they may have received lower than expected income for the electricity they generated. For many now though, it is a welcome boost to earnings in the current financial year.

Selling electricity is a complicated process, and sees a mix of arrangements, from triad deals in the past where EfW plants supplied extra power during surge demand, through to long-term contract arrangements and sales at spot market prices.

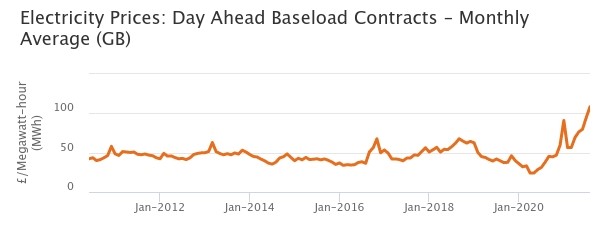

Power value is measured in megawatt hours (MWh). The most recent available data from Ofgem, the government regulator for electricity markets in the UK, shows the price of wholesale electricity rose from £56.51 per MWh in March to £108.33 in August. This is an increase of nearly 92%, while prices continue to rise.

In the EfW market, prices are said to have been as low as £35 per MWh last year, jumping to £150 per MWh in recent weeks.

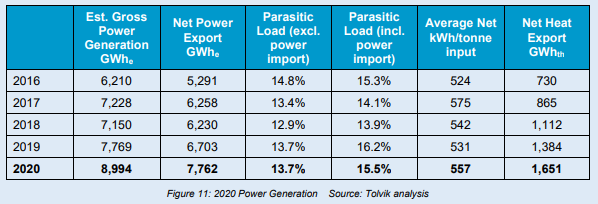

According to data published by consultancy Tolvik in February this year – and sourced from the Department for Business, Energy and Industrial Strategy – the total power exported by EfW plants in the UK in 2020 was 7,762GWh. This means that EfW represented approximately 2.5% of total net UK generation of 307,556 GWh (see letsrecycle.com story). This is seen as underlining EfW’s contribution as a small, but significant provider, to electricity supply.

Contracts

Adrian Judge is an expert on EfW and director of Tolvik. He told letsrecycle.com that there were three different situations in which EfW firms agree contracts.

The first sees companies selling electricity at spot market prices and these would be the ones who received a high price, he suggested. Secondly, Mr Judge said EfW companies largely sell electricity ahead at a fixed price.

The third option sees EfW firms which generate electricity in partnership with local authorities having a ‘gainshare mechanism’ written into their contracts. This sees local authorities benefit from hikes in market prices.

“Those who have done neither of those last two things will be the ones who benefit,” he said. “I would think that more than half have forward service arrangements with fixed prices in place.”

Mr Judge suggested the rise in prices may not last. “History shows us that spikes don’t lie at a really long level for a really long time, but they tend to fall back at a higher level. You take the good times when they come because you know there might be more difficult times in the future.”

Efficiency

Paul James, a consultant and chair of the thermal treatment special interest group at the Chartered Institution of Wastes Management (CIWM), suggested that some EfW companies would benefit from price hikes in the short-term, but firms were more likely to plan for the long-term.

“It depends on for how long energy prices are high. The plants are constructed for a period of 25 years, so you have to take a longer-term view. People building plants won’t consider the high electricity prices now in their long-term financial strategies.”

Mr James said many of the larger waste management companies also operated recycling plants which are users of electricity.

Big companies don’t like very large fluctuations in market rates and neither do investors– Paul James, chair of the thermal treatment special interest group at CIWM

“Big companies don’t like very large fluctuations in market rates and neither do investors. The waste management sector is about trying to provide good quality facilities to manage our waste and extract value from it. Fluctuating energy prices are not very helpful.”

Mr James hopes the higher prices will see a renewed drive for greater efficiency at EfW plants, including the government providing more funding and infrastructure for district heating networks.

“If we’re looking at higher basic energy costs, that should drive more energy efficiency,” he said. “Common sense tells you that if the price of power goes up you should shut the windows and insulate a bit more. The equivalent in the energy from waste sector is that maybe the government will make sure that waste heat can reach district heating networks.”

Risk and opportunity

Suez generates about 120 GWh of electricity a month via its EfW plants and landfill gas. In 2019, it generated enough electricity to power 438,000 homes.

Stuart Hayward-Higham, Suez’s technical development director, told letsrecycle.com: “What we do is we try and marry risk with opportunity. So, we hedge, we buy forwards. We’d sell all the power for a year ahead from a particular plant. That means that that price is locked in.

“If the price drops, we’ve covered off that, and if the price goes up, we don’t get all benefit. What we do as a business is we have a hedged position. Some of the power’s sold long and at a fixed price, and some of it is sold short at the market price.”

Mr Hayward-Higham said Suez sold around 70% of its power at a hedged price.

“It’s not a precise science, but it’s a reasonably good way of managing risk. You lose some of the top end opportunity, but you lose some of the bottom end hazard,” he said. “So, for us and our customers, there’s a nice balance in there where we hedge some of it and we play the market with some.”

‘Gradual impact’

For Veolia, the rise in electricity prices certainly seems to be a positive. In July this year, Claude Laruelle, the company’s chief financial officer, said in an interview with CNBC that Veolia would benefit from increased prices through 2022 and 2023. “We will see a gradual impact on Veolia in 2022 and 2023, but it will be a positive impact because we are net producers of energy from our waste activities and also our combined heat and power activities in Europe.”

According to Tolvik, Veolia had a 16.7% share of the UK EfW market in 2020 based on input tonnages. When contacted by letsrecycle.com, Donald Macphail, chief operating officer for treatment at Veolia UK & Ireland, said: “In recent months, we have seen the market price of electricity increase, although the majority of Veolia’s contracts have long-term price agreements.

“As more baseload generators such as nuclear, coal, and combined cycle gas turbines retire, energy recovery facilities are set to play an increasingly important role in keeping the lights on during winter evenings and during days where wind generation is low.”

Fixed prices

The Environmental Services Association (ESA), the trade body representing the waste sector, was cooler on the idea that EfW firms could benefit from the current market prices. The Association claimed so many companies would be tied into long-term contracts at fixed prices that they would not have received any extra revenue.

An ESA spokesperson told letsrecycle.com that generating electricity was not the focus for EfW, which is seen more as a supplement to renewable power, such as solar or wind. Instead, EfW is an alternative solution to landfill for the disposal of residual waste.

Belvedere

The ESA’s position was backed up by London-based Cory, which operates one of the UK’s largest EfW facilities, on the bank of the River Thames at Belvedere. The Riverside plant is capable of processing up to 785,000 tonnes of residual waste a year.

A company spokesperson told letsrecycle.com that EfW made a “small but important contribution” to the UK’s baseload electricity, “underscored” by the recent gas supply shortage.

They added: “Cory is not benefiting from the energy price rise as we don’t speculate on the market; we support customers that are taking a longer-term approach to energy buying.

“From a commercial perspective, electricity generation – regardless of the market price – will only ever be a secondary part of the important sanitisation and resource management work we do as a business.”

Anaerobic digestion

Elsewhere, while anaerobic digestion (AD) uses waste to generate electricity, it is not technically counted as EfW, as it is a “fully circular technology”, recycling organic wastes. EfW is classified as unsustainable by the EU, while AD is not.

Jon Hughes, head of communications at the Anaerobic Digestion and Bioresources Association (ADBA), told letsrecycle.com that his sector would not benefit from the current high electricity prices “in the long-term”.

He said: “In the long-term, the AD sector won’t benefit significantly from the current increase in energy prices. AD plants are typically built to operate for over 20 years, where wholesale energy prices reflect only a relatively small proportion of their total income.

“Of the plants currently generating electricity, only approximately 4 TWh of electricity is directed to the National Grid, around 1.3% of total electricity consumption.”

Mr Hughes also emphasised that electricity generation was not the core function of the AD sector.

He remarked: “The main value is in helping reduce greenhouse gas emissions, especially methane, both upstream (waste management) and downstream (bioproducts) of the AD process,” he said. “AD currently delivers a 1% reduction in the UK’s annual greenhouse gas emissions. Fully deployed, it could help cut those emissions by 6% by 2030 – over 10% globally. It is therefore a crucial player in the fight against climate change.”

RDF Conference | 25 November | Congress Centre, London

Now in its eighth year, the RDF Conference has established itself as one of the key must-attend conferences for all those operating in the RDF, SRF and energy from waste sectors.

Learn more here.

Subscribe for free