Full details of the tax, which was first announced by the Chancellor in the 2018 Budget (see letsrecycle.com story), were outlined in a 12-week consultation launched this morning.

The consultation is one of four launched today into policies stemming from the government’s Resources and Waste Strategy, including proposals around a deposit return scheme for bottles and cans, extended producer responsibility on packaging waste and consistency of recycling collections (see letsrecycle.com story).

In consultation documents outlining the scope of the tax, the Treasury has confirmed that it will apply to businesses that produce or import plastic packaging using ‘insufficient’ recycled content.

Taking effect from April 2022, the tax will initially set a 30% threshold of recycled content for new packaging. Any packaging products falling below the 30% recycled-content level will be charged a flat-rate per tonne for new packaging placed onto the market.

Tax level

While the tax rate has not been confirmed within the consultation documents, the Treasury has said that it will be set at a level which “provides a clear economic incentive for businesses to use recycled material in the production of plastic packaging.”

It is hoped that the measure will create greater demand for recycled plastic in the UK – as well as creating a demand for greater collection of the material.

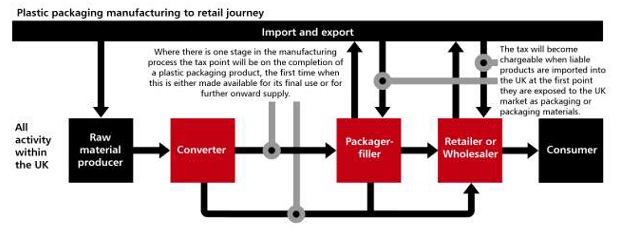

The consultation seeks views on the design of the measure – including definitions of the products that should fall within the scope of the tax, the point at which the tax is applied, treatment of imports and exports, approach to tax rates and how businesses can demonstrate recycled content in their products.

Threshold

On the threshold level for the tax, the Treasury has stated: “The government wants to set the threshold of this world-leading tax at an ambitious level, to reflect the pressing need to act on this issue. The threshold must also be achievable in the foreseeable future for many types of plastic packaging, or large parts of the market will be discouraged from investing in solutions to meet the target.”

However, on the potential for the threshold to be increased in future, it adds: “The government expects supply of recycled material to increase in the future, both as consequence of technical advancements, improvements to collection infrastructure, and the planned reforms to the Packaging Producer Responsibility system. As technical developments and waste collection improve, higher thresholds would become more achievable and could be considered in future reviews of the tax.”

Response

Responding to the proposals today, Stuart Foster, chief executive of the plastic recycling organisation Recoup, cautioned over some of the potential ‘unintended consequences’ of the tax, and questioned where revenues from the measure will be diverted.

“There is a real risk that in striving to reach the target at any cost, we will simply divert recycled material which already has a profitable end market, towards food grade applications, at significant expense, without delivering any meaningful environmental benefit.”

Stuart Foster

Recoup

He said: “There is a real risk that in striving to reach the target at any cost, we will simply divert recycled material which already has a profitable end market, towards food grade applications, at significant expense, without delivering any meaningful environmental benefit. In part this is because food grade recycled plastic is derived primarily from clear PET and milk bottles, HDPE.

“Ultimately the 30% target may make it more difficult and unnecessarily costly for the UK to meet its overall plastic recycling targets. And of course, those currently manufacturing and importing plastic packaging which contains less than 30% recycled material, may simply become free riders in the system or opt to pay the tax, which begs the question, what will HM Treasury allocate these funds to?”

Related Links

Plastic packaging tax: consultation

Subscribe for free