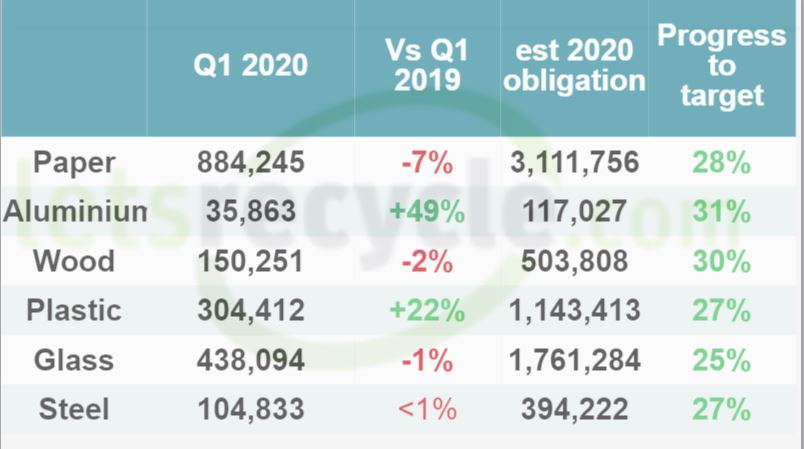

As outlined below the data, released yesterday, 22 April, shows that all materials are on track to hit targets, which are estimated by applying the 2020 targets to the 2019 final obligated data report.

‘Robust system’

Compliance scheme experts aired generally positive views but had some cautionary notes about the sector in light of the pandemic.

Paul Van Danzig, policy director at the Wastepack Group, commented that the figures are positive and showed the robustness of the current PRN system.

He said that while recognising that there may be some valid concerns about the current PRN system, “the figures are positive and there are early signs that material is continuing to be collected, processed and importantly exported too. This shows the robustness of the PRN system; we have a system which appears to be working even in the midst of an unprecedented crisis”.

Concern

Despite promising figures, particularly for aluminium and plastic, there is concern over the effect that lockdown measures could have on the supply of post-consumer material over the next few months.

Sandeep Attwal, procurement specialist at Ecosurety, said: “The publication of the interim recovery and recycling data shows that overall Q1 was a solid quarter for all materials. However there are some immediate concerns when forecasting the supply of post-consumer packaging in Q2.

“Due to the Government restrictions in place for the hospitality sector, non-food retailers and the closure of HWRCs there is an immediate concern that Q2 may see a fall in recycling rates for glass, wood and paper. Until we get sight of demand it is difficult to predict whether lockdown is going to have a negative impact on the PRN market.”

Aluminium

Arguably the best performing material was aluminium, which recorded a 49% increase compared with the same period last year, and achieved 31% of its overall estimated obligation.

This comes amid record high PRN prices for the material, and some expectations throughout 2019 that the target, which was eventually met, would not be achieved (see letsrecycle.com story).

Rick Hindley, executive director at trade body Alupro, said: “While we recognise that Q1 isn’t representative of the whole year, the EA data proves positive reading indeed; with the growth in aluminium recycling seen in 2019 continuing into 2020.

“Alongside greater public awareness about the benefits of aluminium recycling and positive action towards improving resource efficiency, the impressive increase can be partly attributed to a number of new companies – including incinerator bottom ash (IBA) processors – accredited to issue PRNs.

“While it is clearly very early in the year, we are optimistic that, providing local authority collections continue to operate as normal, recycling rates will continue to rise and we will once again surpass annual targets. In parallel, we predict that the unsustainably high PRN prices will fall to a more realistic level.”

Target

The targets for Q1 however are subject to change and are widely estimated by applying the 2020 targets to the 2019 final obligated data report

However, as explained by Phil Conran on the 360 Environmental website, this is based on a number of factors.

“This assumes that packaging placed on the market in 2019 was broadly similar to that placed on the market in 2018. Given that apart from aluminium, the 2018 POM figure (reported in 2019) was fairly flat compared to 2017 (reported in 2018), it would seem reasonable to assume that packaging use in the UK has plateaued although we won’t know this until May when the reported obligated data for 2020 is first published.”

‘Good insight’

Head of trading at the Environment Exchange trading platform, Tom Rickerby, said that the figures provide a “good insight into the health of the recycling markets”, but also warned of the coronavirus risks.

“The market response is likely to be tempered by the uncertainty of the Covid-19 situation”

“In more ‘normal’ conditions the strong results in Plastic, Aluminium and Steel, combined with good carry-in figures would have resulted in downward price pressure in these markets. However, the market response is likely to be tempered by the uncertainty of the Covid-19 situation and an anticipated contraction in PRN supply in Quarter 2,” he stated.

Mr Rickerby added: “The Q1 returns in Paper, Recovery and Glass are less positive, indicating potentially tight markets and justifying the recent upward price trend across all 3 materials. The downturn in Paper generation looks likely to place pressure on the General recycling market.”

‘Strong production’

Martin Trigg-Knight, head of packaging at Clarity Environmental, said to letsrecycle.com that the data only shows a “minimal” impact lockdown restrictions will have on material markets, but also do provide some comfort.

“Overall, the data has revealed very strong production for the first quarter of the year. Plastic, in particular, has performed very well, with an increase of over 60,000 tonnes from this time last year. Although there are some grades affected by the current lockdown, the Q1 data at present shows only a minimal impact on the recycling performance of some materials,” he said.

Mr Trigg-Knight added: “We will continue to assess how it will impact on the markets. In the meantime, this data and the strong carry over from last year, means the industry has made very good progress against the UK obligation. This should provide some much-needed confidence, and a bit of relief that if Q2 is weaker, as some have suggested it might be, it will be moderated by the increased tonnage in the first quarter.”

Environment Agency RPS

The data was published the same week the Environment Agency also relaxed rules around the requirement for obligated packaging producers to register with the Environment Agency, either directly or through a compliance scheme and provide complete and accurate information with the application.

Usually, if obligated packaging producers do not meet these requirements, or they provide false or misleading information, the Agency can take enforcement action.

However, the regulatory position statement this week states that this won’t be the case providing registration takes place by July 2020 (usual deadline April) and supply the correct information.

Subscribe for free