Published on 28 July, the data covers the second quarter of the 2022 compliance year (April-June) and is provisional until confirmed by the Environment Agency.

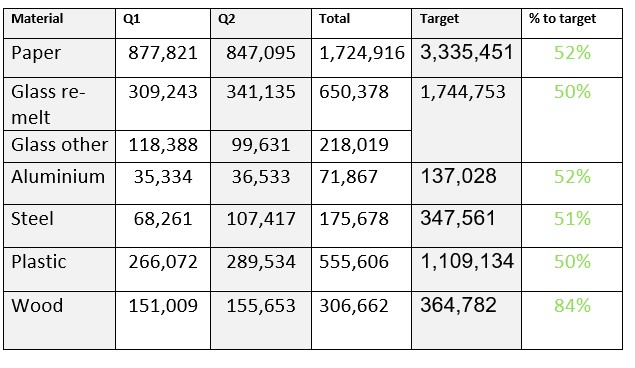

As outlined below, the data shows that all materials are on track to hit their targets for the year, even excluding carry-over figures from 2021.

Targets

However, compliance specialists say the data should, for now, be taken with a “pinch of salt” because there is still a large amount to be published.

Despite this warning, there has been a softening in prices for some materials, including plastic, which had reached upwards of £250 a tonne in July. Today, plastic PRNs were trading at around £170.

Many in the sector also pointed to the fact that tonnages have risen for many materials except for paper and glass aggregate. This could be “key”, they said, because paper is often a large contributor to the general recycling obligation.

Amidst the current “political turmoil”, some expressed further doubt about whether targets can be met come the end of the year.

‘Difficult’

David Daw, projects analyst at Valpak, said it appears far that achieving the targets for some of the materials this year “will be difficult, especially with the current world political and economic situation”.

He added, however, that it appears the higher PRN prices currently being experienced are helping to pull material through.

He said: “Valpak continues to work with its reprocessors to ensure it can obtain enough PRNs for its members’ requirements.

“There is some uncertainty in both supply and demand as both the Q1 and Q2 data reprocessing data are still changing and the obligation for the UK is still yet to be finalised with some outstanding registrations and resubmissions expected to take place.

“For example, there have been a couple of significant corrections made to the obligation in recent weeks which saw falls in the UK reported data for both glass and plastic.”

‘Relaxed’

Martin Trigg-Knight, head of compliance at Clarity Environmental, explained that the current available data “suggests an almost relaxed state of play at July”.

However, he said that, when taking into account that at least one large supermarket and some “very large” brand pack-filler/importers are still to add their own obligations to the mix, “we can then see that demand for PRNs this year is actually larger than we can see in currently available public data.”

He explained: “With this in mind we need to expect a tight next few months for glass and paper, but potentially a more relaxed plastic outlook.

“The relaxed plastic outlook is no doubt due at least in part to the effect of the high plastic PRN price stimulating recycling in the UK and facilitating exports.

“If the heat of this summer increases summer drinking patterns in the way it often does, then we could see glass production too correct itself towards target as the year goes on.”

Mr Trigg-Knight added that increased drinks consumption across a hot holiday season should “at the very least” increase the volumes of glass consumed and collected.

He said the high PRN price should help this material to make its way through the commodity channels into new glass from the better collections and aggregate from lower grades.

Investment

Paul van Danzig, policy director at Wastepack, explained that the higher prices for plastic over the last couple of months have enabled extra investment in recycling, “so it would appear we are on track to reaching target.”

He added: “Providing the remaining two quarters perform equally well, I see no reason why the plastics target won’t be met at end of year.

“Paper, on the other hand, is going the other way. Normally this is a banker and used to contribute towards the general target, but this is running tighter this year.”

These sentiments were echoed by Sandeep Attwal, group procurement manager at Ecosurety, who said: “It was encouraging to see that the extra price support in plastic and steel had led to the increase in supply of these PRNs in Q2.

“However, it was disappointing that the extra fund received by the recyclers/exporters in glass aggregate and paper did not increase the supply of these PRNs.”

Data

Looking forward, all eyes will remain on the data to see how those submitting later will impact the numbers.

People have been concerned about rising PRN prices in recent months, though, so will hope the fact the data shows targets are due to be hit and, with more data to be submitted, prices will settle.

Subscribe for free