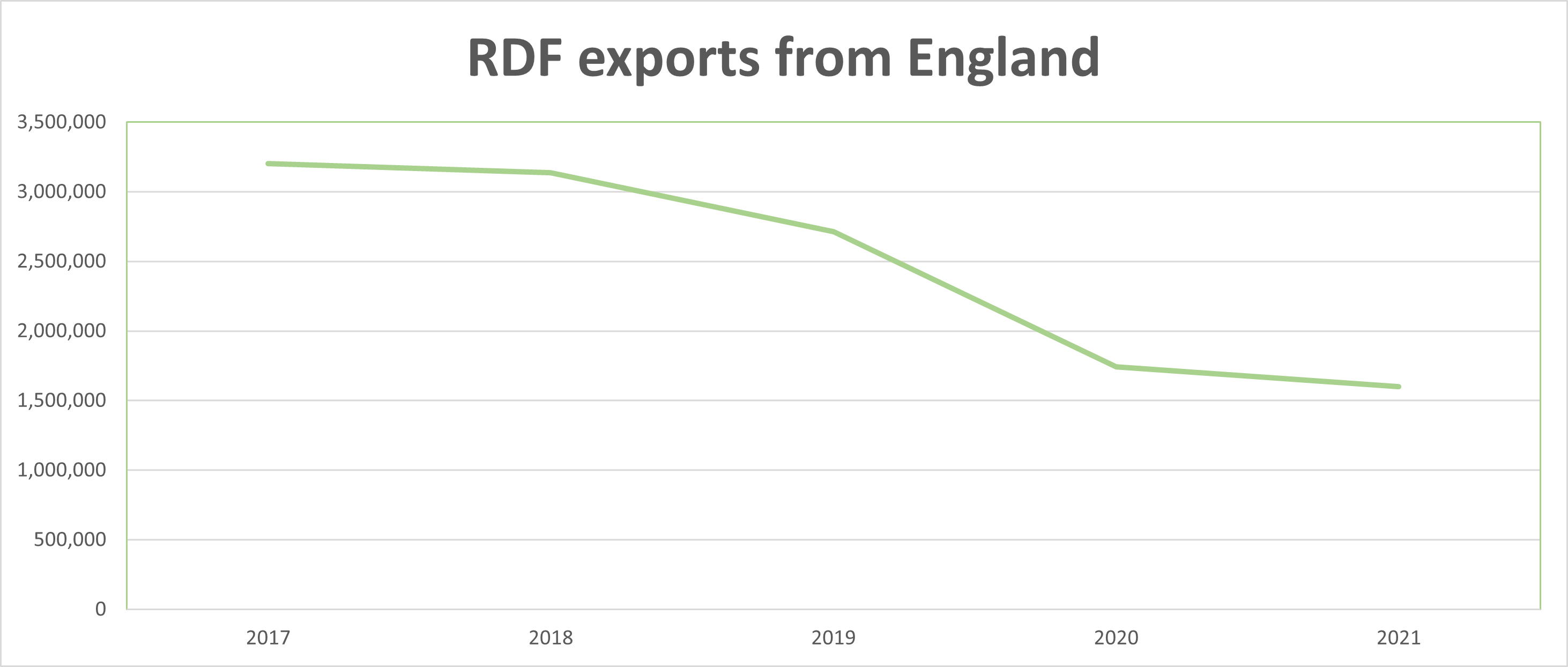

While RDF exports have nearly halved since around 3.2 million tonnes were exported in 2017, the rate of decline has slowed.

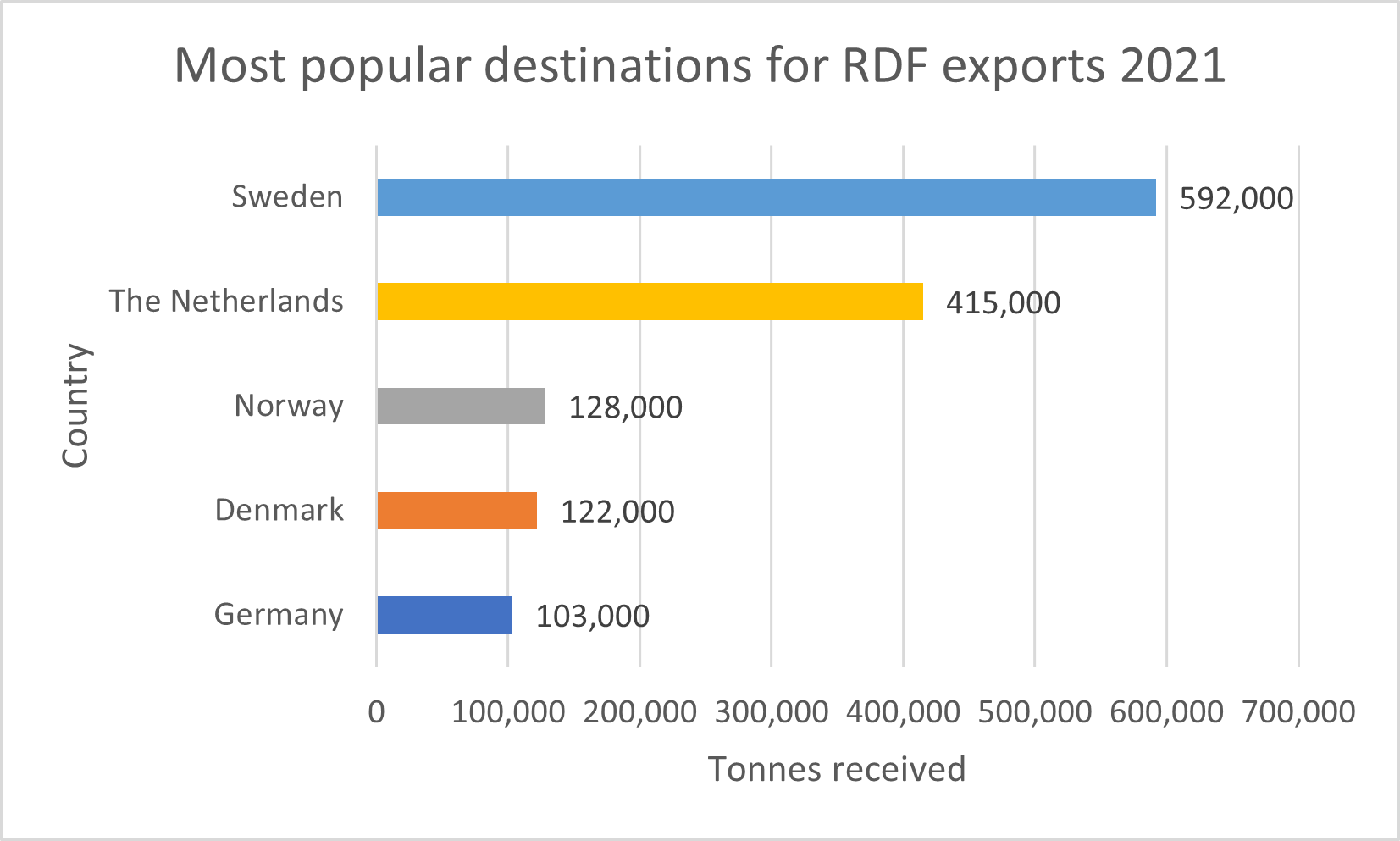

According to data published by consultancy Footprint Services and sourced from the Environment Agency, exports to Germany and the Netherlands, traditionally two of the most popular destinations for RDF, fell by 31% and 48% to 415,000 and 103,000 respectively.

Footprint Services attributes the decline in overall exports, which include solid recovered fuel (SRF), to “turbulence” in the sector caused by Brexit, waste taxes, and the Covid-19 pandemic.

However, Footprint Services says the year-on-year decline in exports has “calmed down somewhat” from falls of more than 30% earlier in the year (see letsrecycle.com story).

The data shows exports of RDF fell by 12% to 1.27 million tonnes but exports of SRF increased by 9% to 353,000 tonnes.

And, exports to Sweden, Norway, and Denmark grew by 20%, 2%, and 166% to 592,000, 128,000, and 122,000 tonnes respectively.

Andrew Gadd, Footprint Services’ company manager, said he expected exports in 2022 to be “pleasantly settled” as European economies emerge from pandemic-related restrictions.

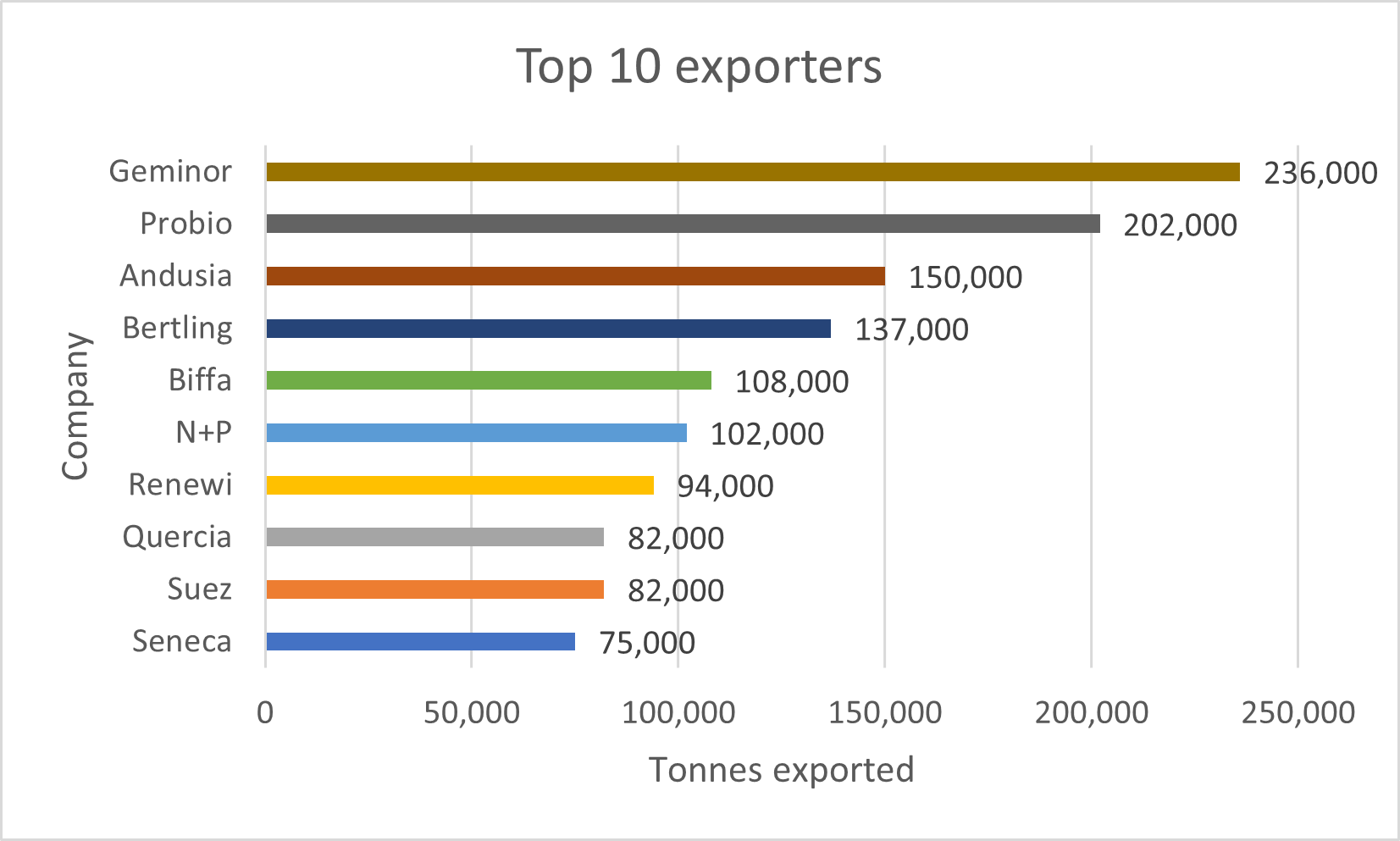

Market share

The three companies which exported the most RDF from England in 2021 were Geminor UK, Probio Energy International, and Andusia Recovered Fuels.

Despite retaining the top spot as England’s most prolific exporter, Geminor’s shipments fell by 10% to 236,000 tonnes.

Yesterday, the Norwegian waste fuel specialist said it now supplies as much waste to the UK’s domestic market as it exports (see letsrecycle.com story).

Replacing Suez and N+P in the top three, Probio and Andusia’s exports grew by 36% and 6% to 202,000 and 150,000 tonnes respectively.

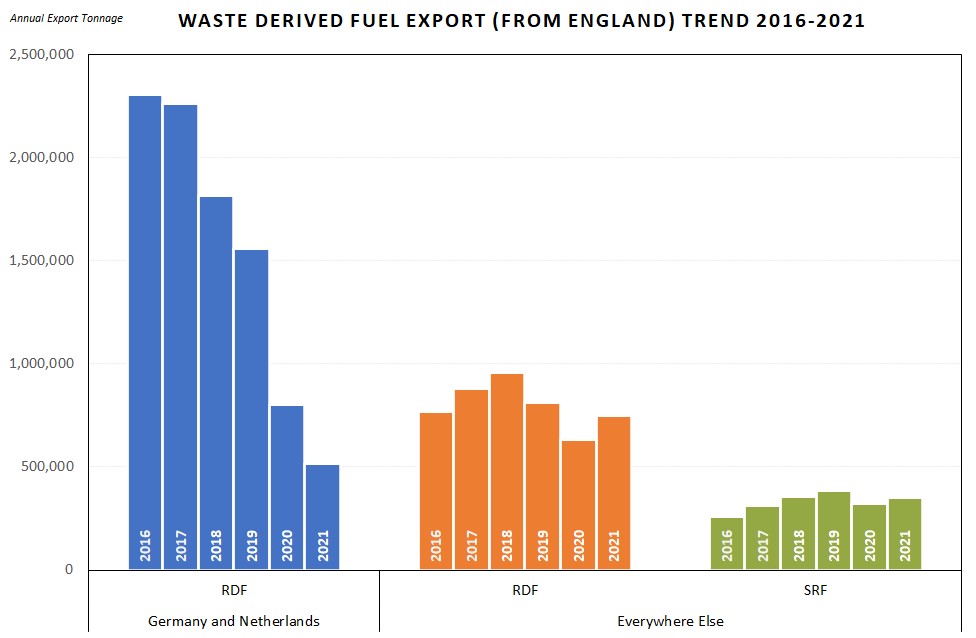

Germany and the Netherlands

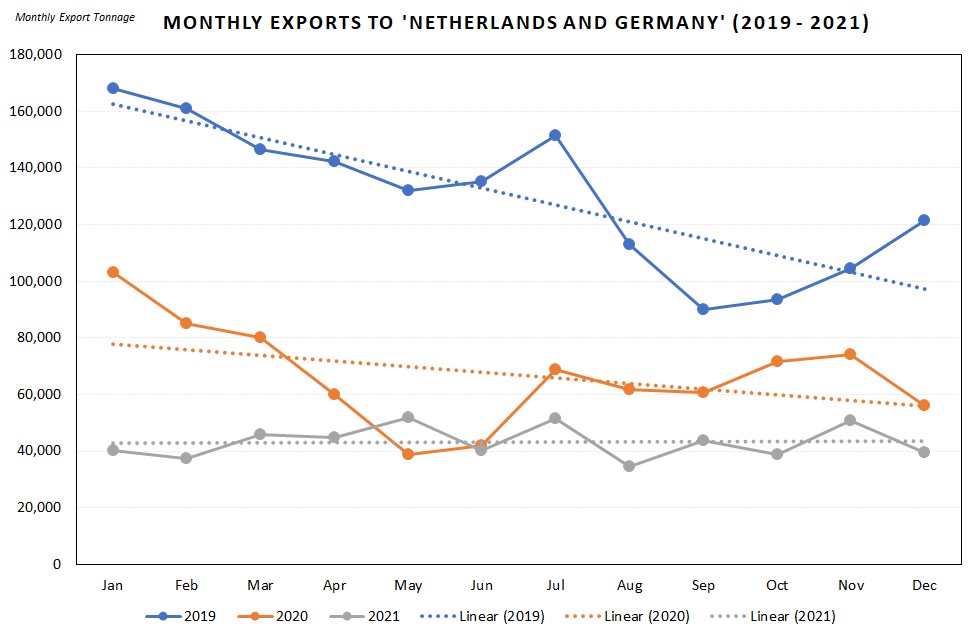

Waste fuels received by Germany and Netherlands have “plunged” from around 2.25 million tonnes in 2016/17 to 500,000 tonnes in 2021, Footprint Services says.

In April 2021, rolling figures showed that Sweden had overtaken the Netherlands as the most popular destination for exports of RDF from England for the first time (see letsrecycle.com story).

However, after years of decline, shipments to German and Dutch companies including Attero, AVR, EEW Delfzijl, and EEW Helmstedt are “relatively robust”, Footprint Services says.

In fact, the consultancy’s data for 2021 suggests the trend in exports to Germany and the Netherlands “may even be heading very slightly upwards”.

2022

After several years of turbulence, Mr Gadd expects exports in 2022 to be “pleasantly settled”.

He said: “As the UK and European economies emerge from the Covid shadow with renewed confidence, I expect there to be more green ink on the RDF export report.

“It won’t be dramatic because there are still waste import taxes – most recently in Norway, amounting to £16 per tonne – and shipping costs are elevated, but I anticipate that the tonnages will gently climb back to 2020 levels.

“Unexpected events may disrupt this uplifting vision – we live in times of unexpected events, after all, and there are tensions and troubles bubbling at Europe’s Eastern border, to name but one.”

Subscribe for free