The consultancy published its 2018 Energy from Waste statistics report at the end of last week, looking at the current and future availability of energy from waste treatment capacity in the country.

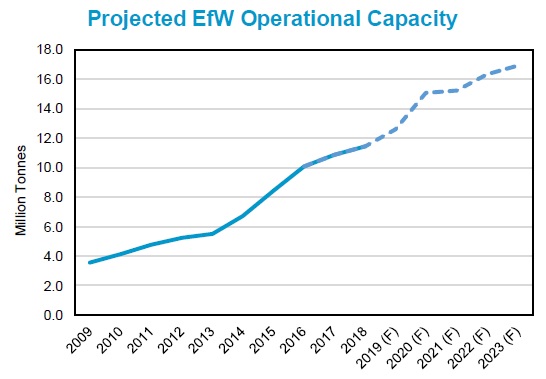

The latest forecast for 2023 represents an increase of around 1.2 million tonnes of capacity compared to what Tolvik had projected in 2018.

This is given a number of EfW projects having reached financial close during the year, as well as additional capacity having been secured at existing facilities.

Current capacity

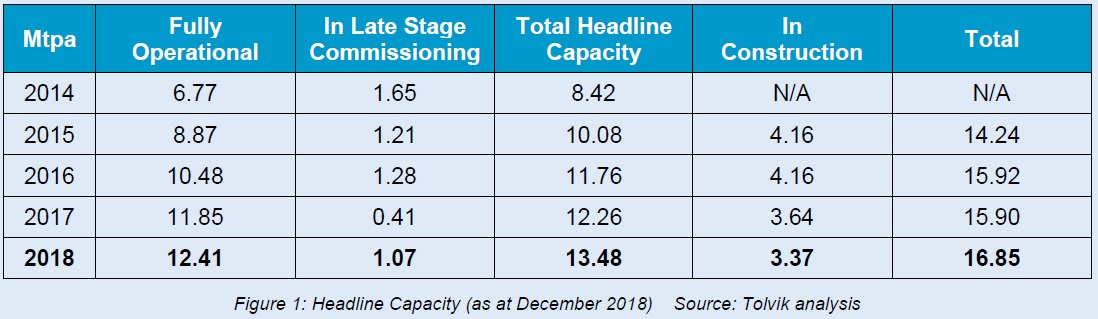

Looking at the current picture, Tolvik suggests that UK energy from waste capacity increased to 13.48 million tonnes in 2018. This is based on operational capacity of energy from waste plants across the UK, as well as the capacity of new facilities currently in commissioning.

According to Tolvik’s figures, as at December 2018, there were a total of 42 operational EfWs in the UK, with a further five accepting waste as part of ‘late stage commissioning’.

Veolia is reported to have the largest overall market share of EfW capacity (2.3 million tonnes), followed by Viridor, Suez and FCC.

As well as the plants currently in operation, around 3.3 million tonnes of additional treatment capacity will come online through facilities that are currently in construction, Tolvik suggests.

Looking at the latest data in comparison to Tolvik’s 2017 report, the new data suggests that the UK’s EfW capacity increased by around 1.22 million tonnes.

Sources of waste

Tolvik adds that in 2018 a total of 11.49 million tonnes of residual waste was processed in UK EfWs, an increase of 5.6% on 2017. The rate of growth has continued to slow down from the 2013-16 peak, Tolvik says.

Around 82.4% of EfW inputs were derived from local authority residual waste, with the remainder coming from commercial and industrial sources, the report suggests. “The continued (albeit modest) increase in C&I Waste inputs reflects the development of “merchant” EfW capacity in the UK,” Tolvik noted.

EfW treatment did not surpass landfill as a route for residual waste, as the consultancy firm had predicted it would in its 2017 report, partly due to “commissioning challenges faced by a number of EfWs during the year”. Additionally, Tolvik estimates that RDF Exports from the UK declined by around 8% when compared with 2017.

Related Links

Tolvik – UK Energy from Waste Statistics 2018

Subscribe for free