A report to the Tower Hamlets cabinet, which recommended that an in-house waste collection, recycling and street cleansing service should be created to “improve services for residents” from April 2020, has been agreed.

The arrangement to take work in house was approved by the borough’s cabinet mayor at the end of October.

According to Tower Hamlets, the move in-house is to be made partly due to an “increased demand” on services brought on by a population increase, as well as cost savings and a need for increased performance.

Costs

The approved plans include one off ‘pre-implementation’ funding of £2.5m, which will finance the creation of a “mobilisation team”.

A £10 million ‘capital investment’ will also be needed for the purchase of a new fleet for the waste and cleansing work and £750,000 for new IT systems. The report says the move will cost £18.7 million to provide both refuse/recycling and cleansing services, with £8.2 million of this for refuse/recycling.

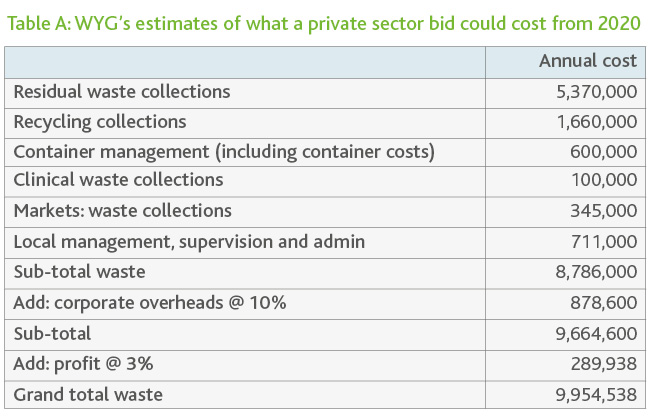

According to Tower Hamlets, the £8.2 million in-house cost is £1.7 million cheaper that the private sector would charge, based on figures from consultancy firm WYG. WYG’s calculations are shown in table A, with a grand total private sector cost prediction of £9.95 million if it was put out to tender.

“This figure is just for operational costs and excludes the costs of supervision, administration, overheads and profit. However, does include for spare staff and vehicles,” the report stated.

Comparison

As part of the research, the report compared costs in the 2016/17 financial year to three neighbouring boroughs – Islington, Newham and Hackney – all of which have an in-house service.

The results showed that Tower Hamlets paid £48.79 per household per year for waste collections in that year. Hackney, by comparison paid £37.58, while Newham was £54.11.

Islington, described as “the most expensive” and as “an outlier”, pays £75.90 per household per year, roughly twice that of Hackney.

“This makes Tower Hamlets 29.8% higher than LB Hackney but significantly cheaper than LB Islington, which is the most expensive by a significant margin,” the report said.

‘First step’

John Biggs, the mayor of Tower Hamlets, said: “This marks the first step in the council’s move towards the delivery of an improved service. It follows on from our recent waste consultation, which generated a huge range of responses from local people and businesses.

“It’s an important decision and one I’m determined we get right for both our residents and the staff involved.”

This was echoed by councillor David Edgar, cabinet member for environment, who added that the council “considered all the options and concluded that bringing services in-house will deliver a better service to residents.”

Staff

The report to the mayor did also pinpoint some risks, explaining that “the experience of authorities bringing services back in house is that some costs can increase. This can be because of changes irrespective of insourcing”.

As a result, the report says its estimated costs across the board take into account risks including to “assume levels of holiday and absence in a comparable but well managed service”.

Performance

The contract between Tower Hamlets and Veolia began in 2006 and covers waste and recycling services as well as street cleaning services.

The council report said there has seen a “lack of consistent performance improvement across, waste, recycling and cleansing services provided by Veolia.”

“Recent improvements have been client led with enforcement of penalties for service failure and proactive contract management to target repeat complaints, hotspots and poor performance,” it said.

Concluding its summary of the contract, the report commented: “Even though Veolia have been working closely with the council, the delivery of continuous improvement, innovation and efficiencies has not been forthcoming.”

Figures

With reference to the consultancy WYG’s estimates of what the private sector might charge from 2020, the consultancy remarks: “Figures for overheads and profit levels are typical of that we see in tenders. We have seen corporate overheads as low as 7% but these are generally accompanied by an increased profit requirement of 5%; and there is little difference to the overall figure in this alternative approach. We have assumed 3% profit and 10% overhead contribution.”

Subscribe for free