Landfill tax changes scrapped

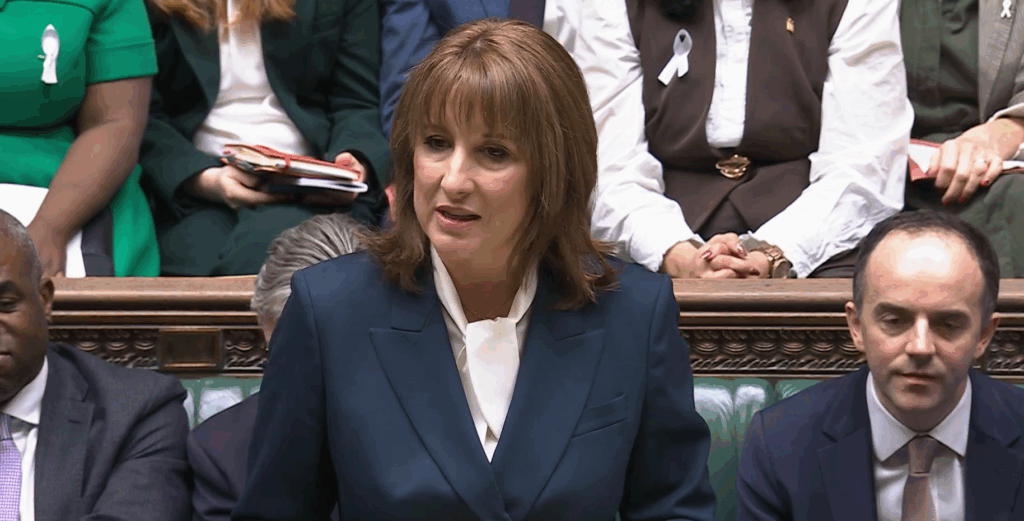

Chancellor Rachel Reeves confirmed that the government will not proceed with plans to converge the standard and lower rates of landfill tax.

The Treasury had explored abolishing the lower rate entirely and restricting exemptions, following concerns raised by the Environment Agency about misclassification of waste to access the cheaper rate.

However, strong pushback from industry leaders prompted a review in September 2025. At the time, the sector warned that the initial proposals would impose “crippling costs” on legitimate operators and undermine the delivery of 1.5 million new homes.

Instead, the Budget confirms:

- The two landfill tax rates will remain, but the government will act to ensure the gap between them does not widen further in coming years

- The exemption for backfilling quarries is retained to ensure housebuilders and construction firms continue to have access to a low-cost alternative to landfill.

The Treasury said it had “listened to stakeholders” and revised its approach to ensure reforms remain proportionate and do not impose unavoidable costs on businesses.

Mark Russell, Executive Director at the MPA, commented on the decision: “The Chancellor’s welcome decision to retain the Quarry Exemption and not proceed with reform to the Landfill Tax is a real relief and follows a significant campaign by MPA.

“The proposed changes would have had a severe impact on the mineral products industry, with a knock-on effect for the UK economy, construction and nature conservation.”

No major changes to Plastic Packaging Tax

The Budget confirmed that PPT rates will rise in line with CPI inflation in 2026-27, maintaining pressure on businesses to incorporate recycled plastic.

Early 2026 will also see a consultation on mandatory certification for mechanically recycled packaging, which businesses will need to claim exemptions from PPT.

As outlined in last year’s Budget, the government will allow chemically recycled plastic to qualify for PPT via mass balance allocation from April 2027.

The mass balance decision was broadly welcomed by the industry, but some have called for more daring reforms, such as the introduction of a progressive escalator for the tax.

Gavin Graveson, CEO of Veolia UK and Ireland said: “It is extremely disappointing that the Government has neglected to make any meaningful increase to the PPT, something the industry has made repeated requests for.

“By not increasing the PPT to £500p/t with a 50% mandatory recycled content threshold, the Government is seriously risking the investment needed for crucial domestic recycling infrastructure, providing green growth and green jobs.”

Crackdown on illegal single-use vapes

Following the single-use vape ban, introduced on 1 June 2025, the Treasury has turned its attention to illicit supply chains and tax evasion in the vape market.

A Vaping Duty Stamps Scheme, coming into force on 1 October 2026, will require all UK-manufactured or imported vape products to carry duty stamps so that illegal products can be immediately identified.

The Budget also confirmed that there will be increased high street enforcement aimed at cracking down on non-compliant vapes.

Association of Convenience Stores Chief Executive James Lowman added: “The activity of rogue traders currently vastly outpaces the level of enforcement, so criminals are willing to take the risk.

“Our members would welcome targeted action to disrupt the illicit trade that undermines responsible retailers across the country, but new powers and penalties will only be effective if Trading Standards officers have the additional resources they need to enforce locally.”

Funding for Defra

The Autumn Budget provided new funding commitments for Defra, although total departmental spending will see the department’s budget reduced, as outlined in the Spending Review 2025.

Targeted Defra grants will be made available to help public bodies remediate land where landfill tax creates an unaffordable barrier to development.

The Government said this will unlock more land for redevelopment while still delivering a net increase in remediation-related landfill tax receipts.

Subscribe for free