The research aims to encourage resilient clean energy supply chains and calls for the UK to establish further domestic recycling capacity.

When it comes to manufacturing, nearly all of Europe’s battery capacity is owned by Asian firms – 86% of which are based in South Korea.

The report “Resilient by Design: Building secure clean energy supply chains” – warned that the UK’s currently level of battery supply-chain dependence could result in up to 90,000 jobs being at risk if a severe, year-long disruption was to occur.

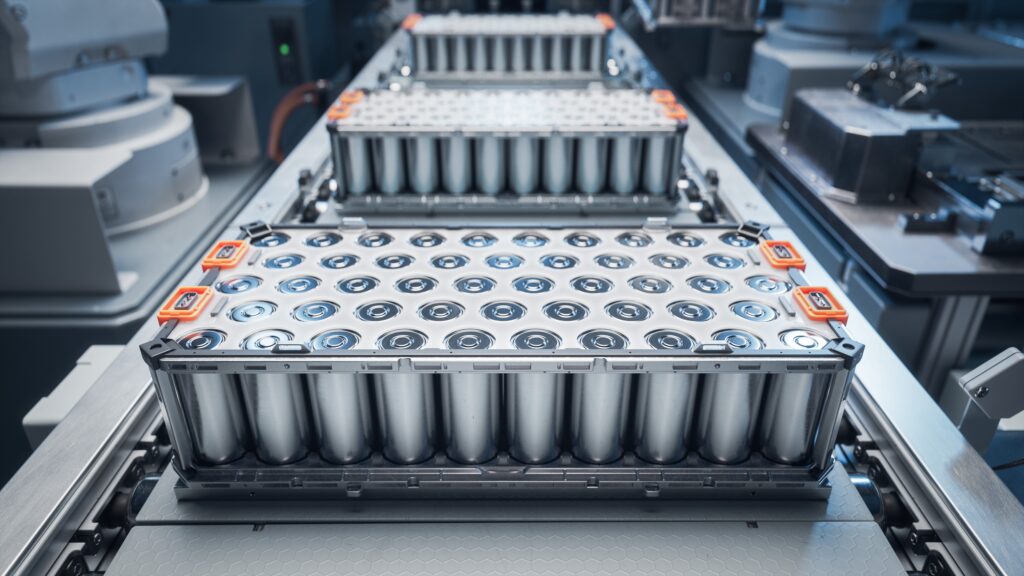

The global demand for batteries is expected to dramatically increase in coming years in keeping with the shift towards electrical vehicles (EVs).

The report predicted that global demand will increase sixfold by 2035.

Much of this is being driven by European car manufacturers, with Europe’s overall share of global demand expected to almost double by 2030.

Altilium cathode recycling

The UK currently has multiple battery recycling facilities under construction.

Altilium is currently building a four-acre facility in Plymouth with the capacity to recycle 24,000 EV batteries annually.

The minerals will be recovered using Altilium’s trademarked EcoCathode process which turns battery scrap into Nickel Mixed Hydroxide Precipitate (MHP) and Lithium Sulphate to be used for the domestic production of battery cathodes.

While the company is UK-based, its funders include Mizuho Bank and trading and investment group Maurbeni, both of which are Japanese-owned.

The technology group is also in the process of developing a Teesside hub which is reportedly set to be one of the largest electric vehicle recycling facilities in Europe.

The site will have the capacity to process scrap from over 150,000 electric vehicles per year and has been designed to handle a mixed feed of battery chemistries.

Altilium hopes to be able to meet 20% of the UK’s cathode demand by 2030 through this facility.

Battery recycling capacity in the UK

IPPR’s research found no companies other than Altilium with an estimated production capacity for battery cathodes.

It warned that this means that 80% of demand will therefore need to be met through imports and puts the UK in a vulnerable position unless additional investments are made into domestic capacity.

The report concluded: “A proactive policy approach to increasing supply chain resilience can help diversify supply, foster partnerships with emerging producer nations, and strengthen domestic capabilities in certain areas.”

Subscribe for free